As we approach the end of a surprisingly resilient year, we think it’s a good idea to look at where we’ve been and where we stand on the venture capital (VC) front. Here’s that look in four charts, according to private equity data provider Pitchbook.

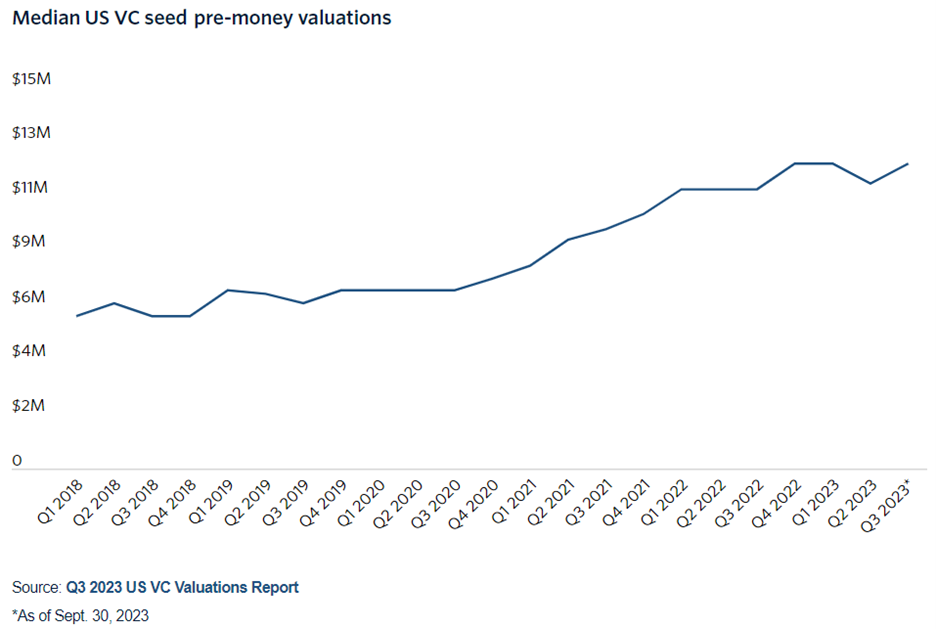

Median US VC Seed Pre-Money Valuations

The first look below is of the median VC seed pre-money valuations for the U.S. Interestingly, the upward trend in pre-money valuations has moved up to $12 million in the third quarter, up from the $11.2 million in the second quarter. Median pre-money, seed valuations ended 2022 at $12 million and ended the first quarter of 2023 at $12 million. Overall, when judged by this valuation measure, VC pre-money valuations are doing just fine, much better than what some predicted heading into 2023.

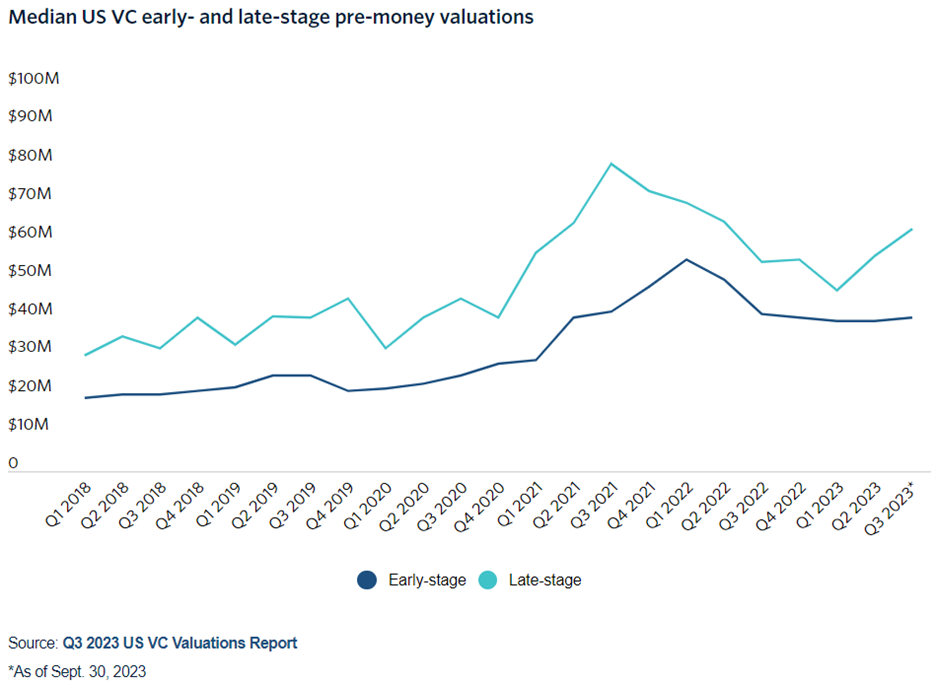

Median U.S. VC Early- and Late-Stage Pre-Money Valuations

The following figure looks at the median U.S. VC early- and late-stage pre-money valuations. Interestingly, by this measure, late-stage companies’ valuations peaked in the third quarter of 2021 at $80 million. Early-stage companies’ valuations peaked in the first quarter of 2022 at $55 million. Perhaps most interesting from this view is that late-stage valuations have started to rise, up to $63 million from the 2023 first quarter’s value of $47 million. In contrast, early-stage valuations have been persistently flat since the third quarter of 2022.

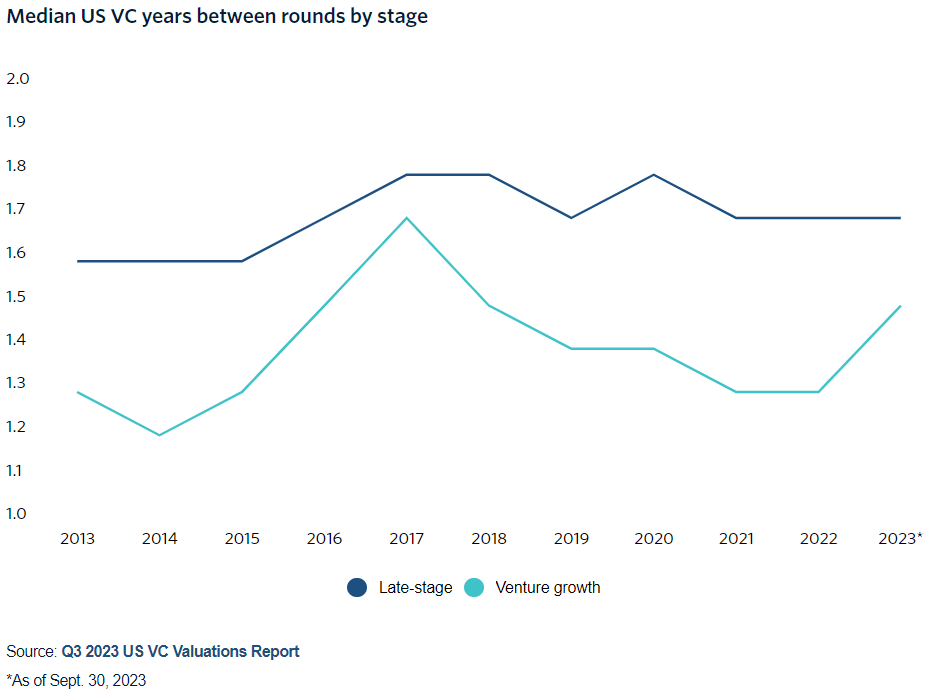

Median U.S. VC Years Between Rounds by State

The third view is median U.S. VC years between rounds by stage. As one might expect, the median years between rounds has been flat since 2021 for late-stage companies, while the years between rounds jumped for venture growth companies to 1.5 years in 2023 from 1.3 years in 2022.

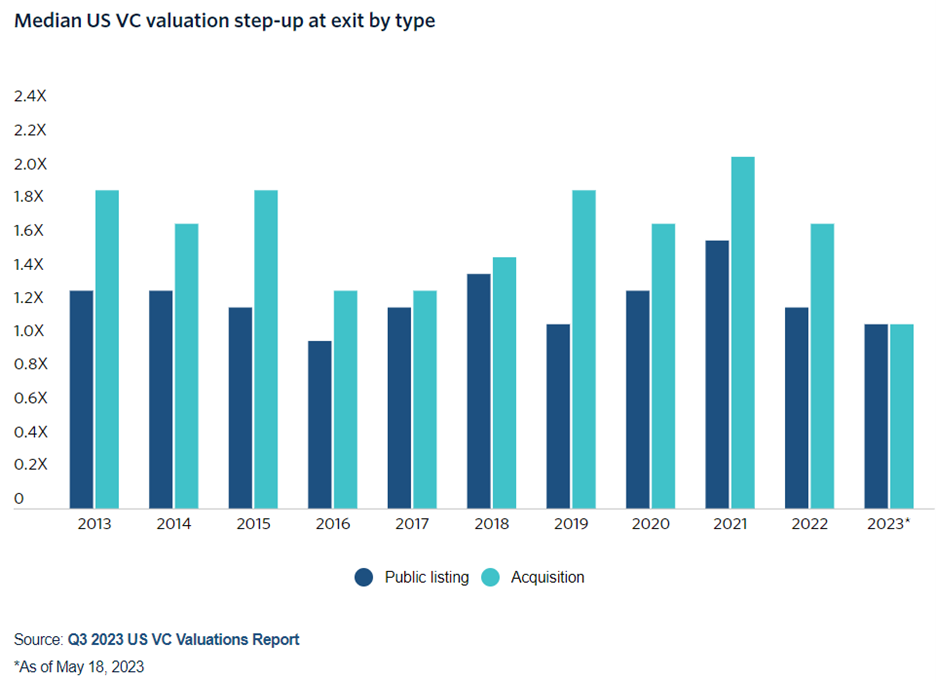

Median U.S. VC Valuation Step-Up at Exit by Type

Our fourth look is of the median U.S. VC valuation step-at at exit by type. For the first time, the public listing step-up at exit equaled the acquisition step-up in 2023. This was due to a much stronger decline in the acquisition step-up from 2022 to 2023 (going from 1.7x to 1.1x) compared to the smaller drop for public listing (going from 1.2x to 1.1). Although we have never seen public listing surpass acquisition step-up, it’s conceivably possible that in 2024, we could see just that.

Summing Up

Overall, the VC world has withstood the potential for deep weakness. Instead of declining precipitously in an economy that was supposed to weaken, the economy – and venture capital valuations – have held up quite well. What the 2024 horizon holds remains on the debating docket, but as of now, the VC world is doing just fine, much better than what many observers thought would be the case heading into 2023.

Comments on this entry are closed.