The venture capital (VC) landscape has always been a playground for risk, driving the economy’s most transformative ideas from conception to reality. As we step into 2024, this ecosystem is poised for another interesting chapter, teeming with potential for a boom or a bust and marked by distinct trends and shifts.

What VC Professionals Think on the 2024 Fundraising Front

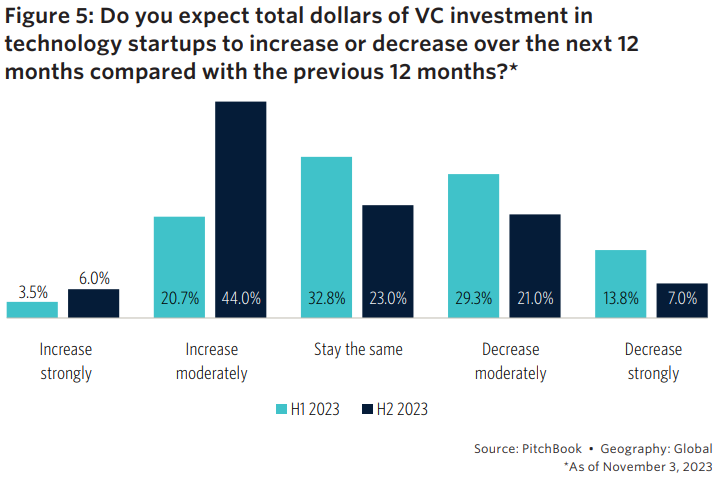

Before delving into some 2024 thoughts, the following graphic is from private equity data provider Pitchbook. Overall, private equity and venture capital professionals are a little more optimistic now than they were six months. Interestingly, there is no clear consensus among the group for the fundraising outlook, with the most common response at 44% saying that they think their funds will see a moderate increase in fundraising.

Could There Be Some Industry Reshaping Through Tech Convergence?

The potential for a convergence of technologies continues to be a pivotal force, potentially reshaping industries and spawning potentially game-changing investment opportunities. Among the fusion possibilities are AI, blockchain, and IoT (Internet of Things). In the optimistic world, these technologies are opening new doors to groundbreaking solutions in healthcare, finance, and beyond. Investors are keenly eyeing startups harnessing this potential convergence, aiming not just for disruption but for sustainable, scalable innovation.

Rise of Sustainability-Centric Ventures

Some investors have a myopic focus on environmental concerns. The VC landscape in 2024 could see a surge in sustainability-focused startups. From renewable energy ventures to sustainable agriculture and circular economy models, some investors are betting big on companies that align with the left-leaning ESG (Environmental, Social, and Governance) principles.

Metaverse: A New Frontier for Investments

The concept of the metaverse has shifted from sci-fi speculation to a tangible investment prospect. As virtual and augmented reality technologies advance, VCs are exploring opportunities within this burgeoning space. Startups working on metaverse infrastructure, immersive experiences, and digital assets are attracting considerable attention and funding, indicating a potential paradigm shift in how we interact with digital environments.

Geopolitical Realities Impacting Investments

Geopolitical shifts and global events always have a ripple effect on the VC landscape. With a focus on diversification and risk management, VCs are recalibrating strategies to navigate these uncertain geopolitical waters, seeking resilient ventures with a global outlook and adaptable business models.

The Dawn of Web3 and Decentralization

Web3, championed by blockchain technology, is gaining momentum, promising a decentralized internet ecosystem. This paradigm shift from centralized platforms towards decentralized, user-owned networks is attracting VC interest. Startups exploring decentralized finance (DeFi), NFTs (Non-Fungible Tokens), and Web3 infrastructure are drawing substantial funding as investors foresee the potential to revolutionize traditional industries.

Challenges and Opportunities Ahead

Amidst these exciting prospects, challenges persist. If the economy continues expanding, there’s the risk that we will see inflated valuations and increased risk of companies going belly-up. Furthermore, market volatility and regulatory uncertainties pose hurdles for investors seeking long-term stability.

However, as every investor knows, these challenges come hand in hand with potential opportunities. The global push for innovation, coupled with a growing appetite for tech-driven solutions, provides fertile ground for visionary entrepreneurs and forward-thinking investors. Collaboration, adaptability, and a keen understanding of emerging trends will be key to harnessing the potential of the VC landscape in 2024.

Conclusion

The venture capital landscape in 2024 presents a risky tableau of innovation, driven by the potential for technological convergence, sustainability imperatives, the metaverse’s emergence, geopolitical dynamics, and the dawn of Web3. As investors navigate this landscape, the year ahead promises to potentially be a transformative one, shaping industries for years to come. Ultimately, success will hinge on the ability to identify and nurture ventures that not only disrupt but also endure, driving lasting change in a rapidly evolving world.

Comments on this entry are closed.