In 2023, fintech venture capital (VC) came in at $34.6 billion. According to venture capital and private equity data provider Pitchbook, that represented a year-over-year decline of 43.8%. Interestingly given the common view that fintech his generally focused on the consumer, about 72% of the total fintech VC dollars went to business-to-business applications, a sharp rise from the 41% in 2019. Here’s a review of some other things happening with fintech investing.

The Quarterly View

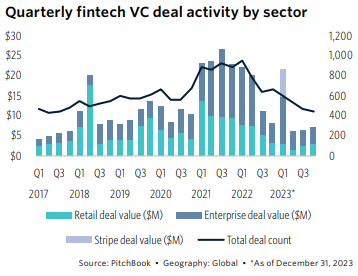

The first view is the quarterly view by sector. In light blue is retail deal value. In dark blue is enterprise deal value. In light purple is Stripe deal value. And the dark line represents total deal count.

Interestingly, and perhaps disappointingly if you’re a fintech startup, total deal activity towards the fintech space peaked two years ago at almost 1,000 deals. Since then, deal count has precipitously declined to just over 400 through the third quarter of 2023.

In terms of deal value, this measure peaked in the third quarter of 2021at just over $25 billion in that quarter. Fast forward to the most recent figures, and deal value in the third quarter of 2023 was at around $6 billion. Money is getting tighter, and certainly getting tougher for financial innovators.

Where were the biggest deals?

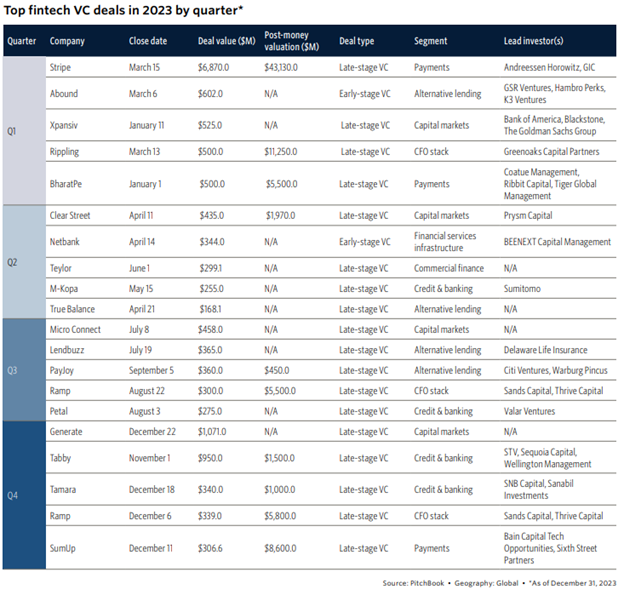

Given this background, where were the biggest deals in 2023? The following table from Pitchbook has that look by quarter. The largest deal was Stripe. Stripe closed on March 15, 2023, with a deal value of $6.9 billion at a post-money valuation of a whopping $43 billion . The late-stage VC investment in the Payments sector was led by Andreessen Horowitz and GIC.

The second largest fintech deal in 2023 was Generate for $1.1 billion. Interestingly for curious observers, the post-money valuation was not disclosed.

Rounding out the top three was Abound at $602 million. The alternative lending platform did not release its post-money valuation after the massive draw from GSR Ventures, Hambro Perks, and K3 Ventures.

Fintech VC Exits

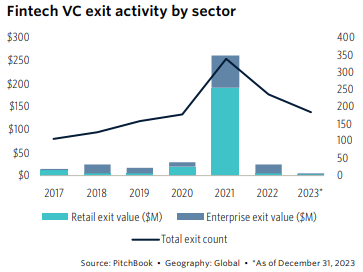

The last view here is fintech VC exits by sector by year. Unsurprisingly, 2021 was an amazing year for fintech VC activity. In 2023, retail and enterprise exit value has come to a standstill, with very little exit activity happening. Interestingly, although exit activity when measured in dollars is quite low, total exit count is still in the 175 range, above where it stood in any year except for 2021 and 2022. Interesting!

Summing Up

Overall, fintech activity continues to slow from its astronomical 2021 levels. If you talk to someone on the street, there certainly continues to be interest, although it’s hard to see that interest in the money.