One of the hottest terms in the investing world today is generative artificial intelligence, sometimes shortened as Gen AI. Given the interest from the VC and PE world, here’s a look at private equity data provider Pitchbook’s take on the state of Gen AI investing.

The Overall Picture

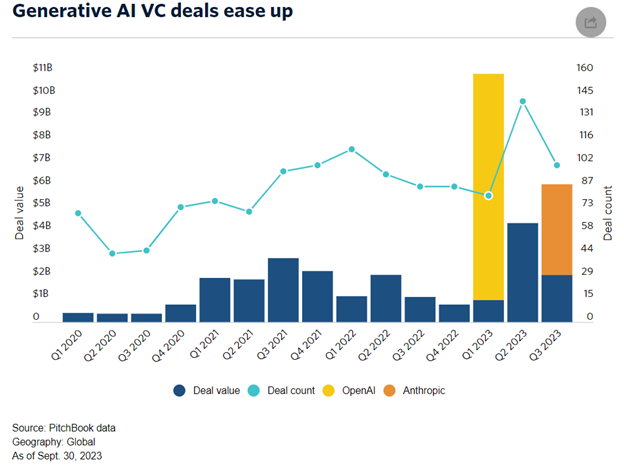

The following figure has an overall look at the Gen AI picture from the first quarter of 2020 through the third quarter of 2023. The figure is short because Gen AI doesn’t have a long history of investor interest. As insiders well know, we’ve only recently had the computing power to bring many forms of Gen AI to the consumer.

Overall, on the number of deals, VC investment in Gen AI ticked down in the third quarter of this year to 101 deals. The number of deals, according to Pitchbook, peaked in the second quarter at 142, which was a marked rise from the first quarter deal count of 81. The number of deals has generally trended up over the past three years, going from 70 in the first quarter of 2020 to the most recent estimate of 101.

(As a note, some observers have found it somewhat odd that deal counts have not grown faster. The answer to this “curiosity” is that Gen AI deals tend to be focused on few companies because the amount of data needed to really perform Gen AI is massive, and as such, requires significant investment in the infrastructure to make the consumer facing component of Gen AI work.)

Deal Value

Shifting to the deal value, the total estimated deal value reached $6.1 billion in the third quarter of this year, a marked rise from the $4.4 billion in the second quarter. The only quarter to have seen stronger deal value was the first quarter of 2023, which saw deal value explode to $11 billion. Of course, one company was responsible for the massive jump – OpenAI. In the first quarter, OpenAI garnered $10 billion in support from mostly large investors (including corporate investing arms).

Prior to the incredible strong dollar figures of 2023, the previous peak in deal value occurred in the third quarter of 2021 at $2.8 billion. This seems quite small compared to the 2023 values, but one must remember that two companies accounted for the first and third quarter jumps in deal values – the previously-mentioned OpenAI and Amazon-backed Anthropic ($4 billion).

Summing Up

Overall, although generative AI dealmaking slowed in the third quarter of this year, venture capital interest in the sector continues to trend upwards. Time will tell whether the hype surrounding generative AI is worth an investment. The evidence up to this point suggests the answer is yes, but so has been the answer for past technological booms in specific sectors that eventually turned south.

Comments on this entry are closed.