A Snapshot of Global Markets

Economic conditions have generally turned out better than what most economists had expected heading into 2023. As we enter the last quarter of the year, what does the global private equity market look like? Here’s a look, according to a recent note out of private equity data provider Pitchbook.

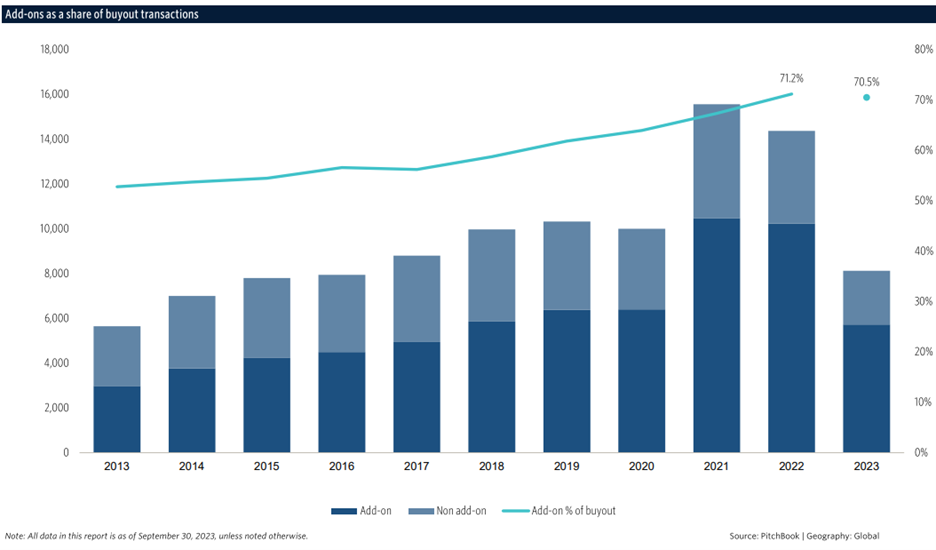

Add-ons as a Share of Buyout Transactions

The first look below is add-ons as a share of buyout transactions. (As a note, add-ons are purchase of a smaller-sized target by an existing portfolio company.) Overall, 2023 through the first three quarters is doing fine. As of September 30th, add-on percent of the buyout amount stood at 70.5%, down slightly from 71.2% in 2022. On add-on value, the current trend suggests that global add-on activity will approach $8 billion, well above any prior year with the exception of the pandemic-induced slush money of 2021 and 2022.

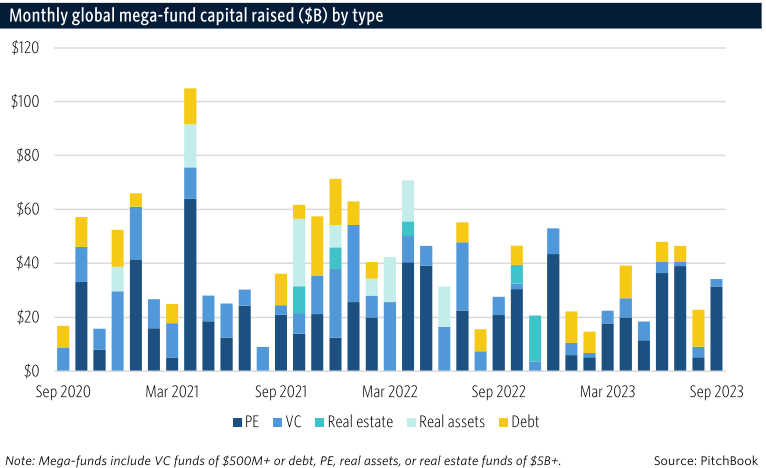

Monthly Global Mega-fund Capital Raised

The next view is of the monthly global mega-fund capital raised. Before looking, which of these sectors would you guess accounted for almost all of the global mega-fund capital raised in September 2023: private equity (PE), venture capital (VC), real estate, real assets, and debt? Interestingly, the answer is private equity. Of the approximately $35 billion raised in September, almost 90% of the funds raised went to private equity. The only other asset class that registered anything meaningfully was venture capital at less than $3 billion.

Interestingly, in July, the biggest money-raising asset class was debt at more than $10 billion, with PE and VC accounting for around $4 billion each.

Perhaps the most interesting takeaway from this view is the massive amount of cash inflow into all of the asset classes in 2021. All that federal spending certainly showed up somewhere!

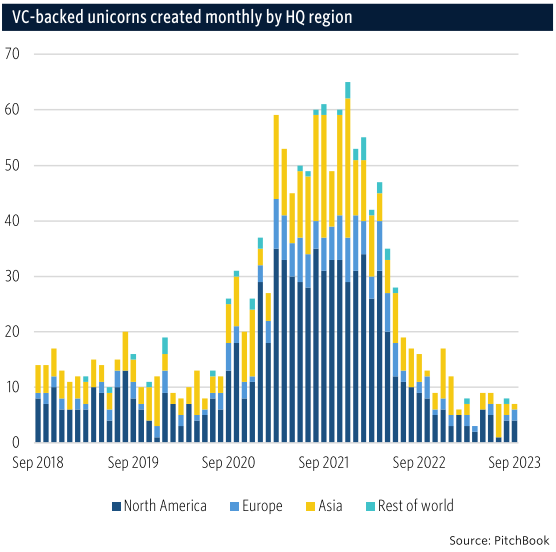

Venture Capital-Backed Unicorns Created Monthly by HQ Region

Our last look here is of VC-backed unicorns created by month by headquartered region. Of these regions – North America, Europe, Asia, and the Rest of the World – which one would you guess saw the greatest number of unicorns created? Which area comes in second?

First place is likely no surprise. Unicorns are created at a very disproportionate rate in North America than in other areas around the globe. What might be surprising to some is that Europe is not in second place. The creation of unicorns is much more likely in Asia than in Europe, with the shift having happened over the past decade. If you’re a Europe fan, there’s lots of catching up to do!

Summing Up

Overall, contrary to some contrarians, global markets are doing ok. Private equity, although softer than it was in the hot-hot 2022, is still on track to be a good year. Of course, the bigger concern now is 2024. How will private equity and global markets hold up in 2024 when higher interest rates begin to really take a bite. We shall see.

Comments on this entry are closed.