Every quarter, private equity data provider Pitchbook releases its accounting of the state of private equity. The most recent release for the first quarter of 2023 presents a surprisingly strong sector heading into what may turn out to be a very difficult economic year. Here’s a review.

The PE Picture by Quarter

The first look is private equity (PE) activity by quarter. Interestingly, activity was still quite strong through the first quarter of 2023. The estimated deal count reached about 2,200, down from the 2022 strength, but still above activity seen in the pre-pandemic era. On deal volume, deal volume reached a high of a little over $350 billion in the fourth quarter of 2021, and has generally trended down, although the 2023 Q1 result of about $250 billion (including estimated deal value) was surprisingly strong relative to its historical experience.

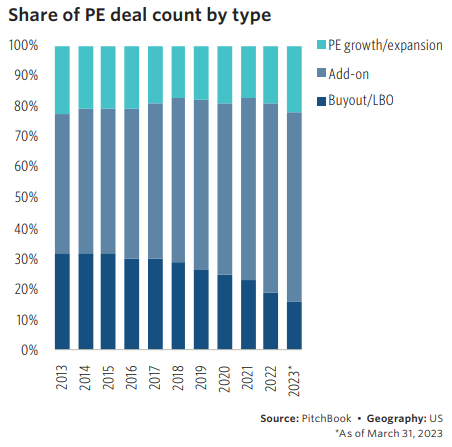

Deal Count by Type

The next view is the share of PE deal count by type. Overall, the PE growth/expansion sector accounted for around 25% of all PE activity in the first quarter of 2023, which was up from approximately 20% at the end of 2022. The Buyout/LBO sector cooled, dropping to around 15% of all activity from a 2022 take of around 20%. The largest sector, by far, was the Add-on sector, accounting for around 55% of all deals. Investors continued to focus on bets they had made previously.

Median PE Deal Value

The next view is the median PE deal value. Interestingly, the median PE deal value was off only slightly from the 2022 year-end value of $50 million. The $45.3 million Q1 2023 value was higher than most of its historical experience, although it does represent a second year of cooling after the extraordinarily high $70 million median value that we saw in 2021.

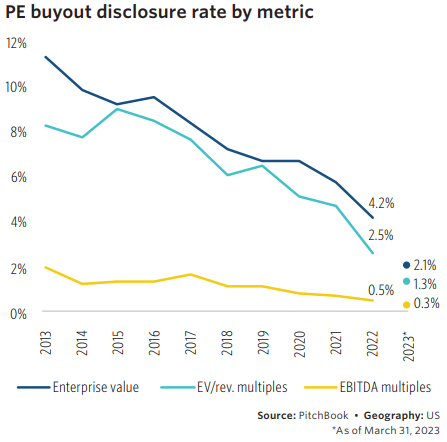

PE buyout disclosure rate by metric

The next view is the PE buyout disclosure rate by metric. Overall, the trend was down for all three metrics. For Enterprise value, the buyout disclosure rate dropped to 4.2%. For EV/rev. multiples, the buyout disclosure rate dropped to 2.5%. And for the EBITDA multiples, the buyout disclosure rate declined to 0.5%.

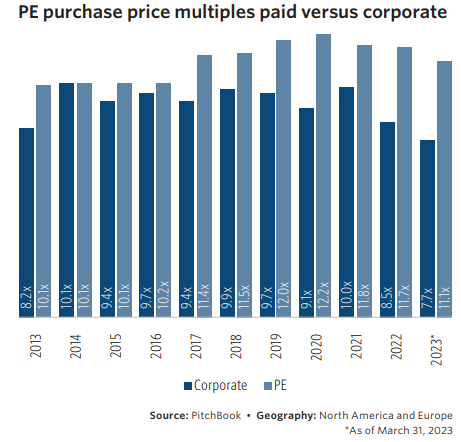

The PE Purchase Price Multiples Paid Versus Corporate View

The last view presented here is the PE purchase price multiples paid compared to corporate. Overall, though Q1, the PE multiple continued to drop from its 2020 peak of 12.2x, with the most recent value at 11.1x. This was still above the corporate multiple of 7.7x.

Summing Up

Overall, although the broader economy appears to be weakening with the onset of higher interest rates and high inflation, the PE sector continues to plow forward with healthy activity through the first quarter of 2023.

Comments on this entry are closed.