In recent years, investors have taken a shine to private debt. Given the increased interest, here’s a review according to a recent report out of private equity data provider Pitchbook.

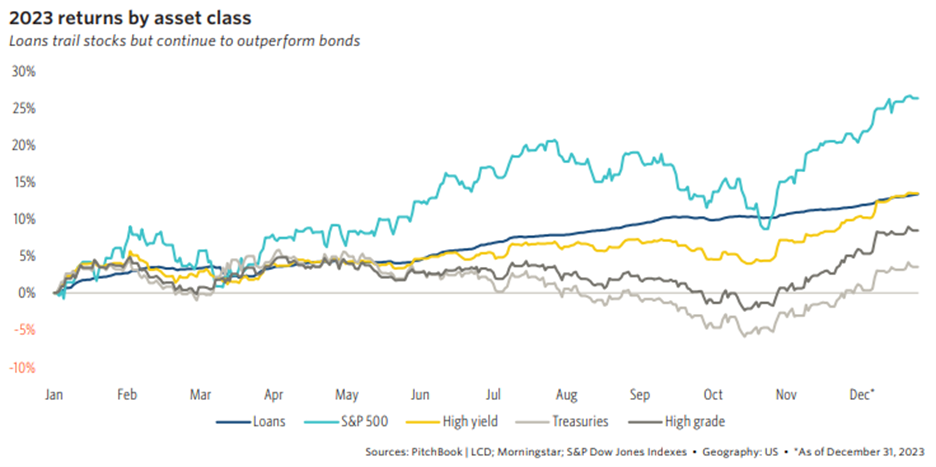

The Broader Picture

The first view is the broader picture of returns for 2023. Loans, as measured by Morningstar’s LSTA Index, performed well, up 13% for 2023. This was in line with the returns of High yield bonds, and much stronger than the returns of Treasuries and High grade.

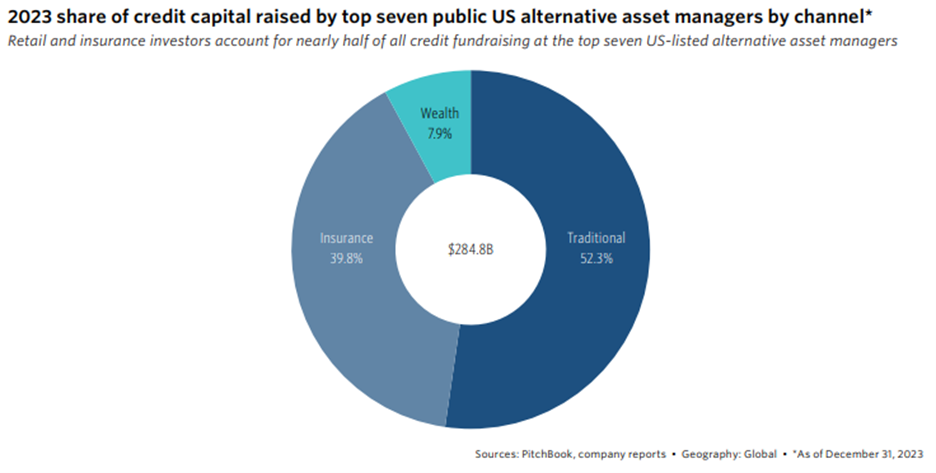

Where is the fundraising coming from?

Which entities are investing in private credit fundraising? Interestingly, the top source of funds in 2023 was Traditional at 52%, implying that almost half of all fundraising was from non-Traditional source. Leading out of the non-Traditional providers was Insurance at almost 40%, followed by Wealth at about 8%.

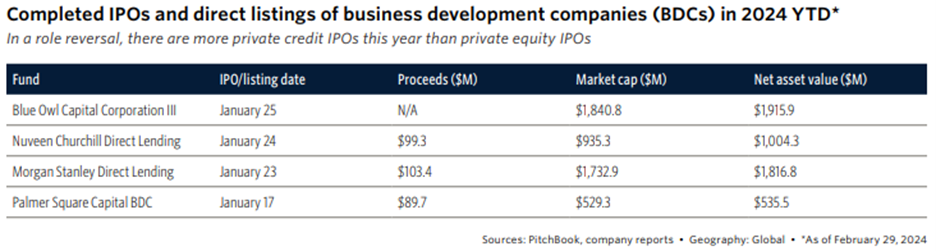

More private credit IPOs than private equity IPOs?

Perhaps one of the more fascinating findings from the Pitchbook report is that there have been more private credit IPOs than there have been private equity IPOs. Simply amazing, and maybe not a good trend. In any event, the next table has four private credit IPOs of 2024. On top is Blue Owl Capital Corporation III at $1.9 billion, followed by Nuveen Churchill Direct Lending at $1.0 billion, Morgan Stanley Direct Lending at $1.8 billion, and Palmer Square Capital BDC at $536 million.

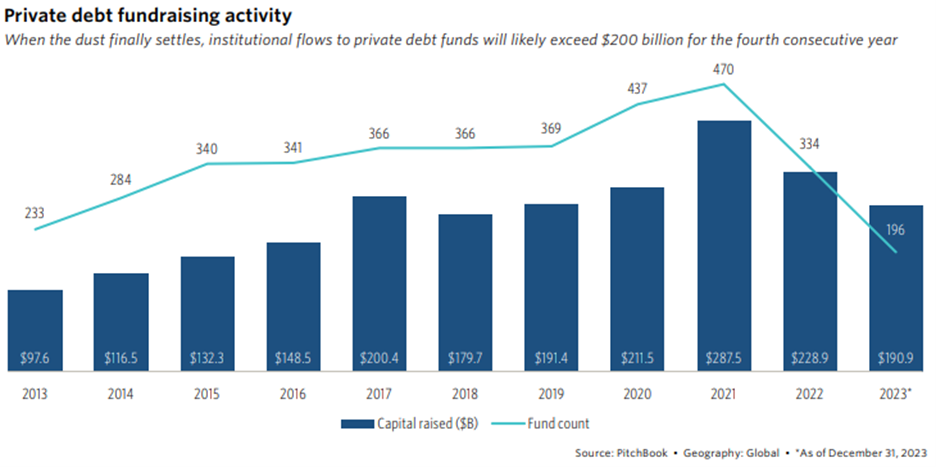

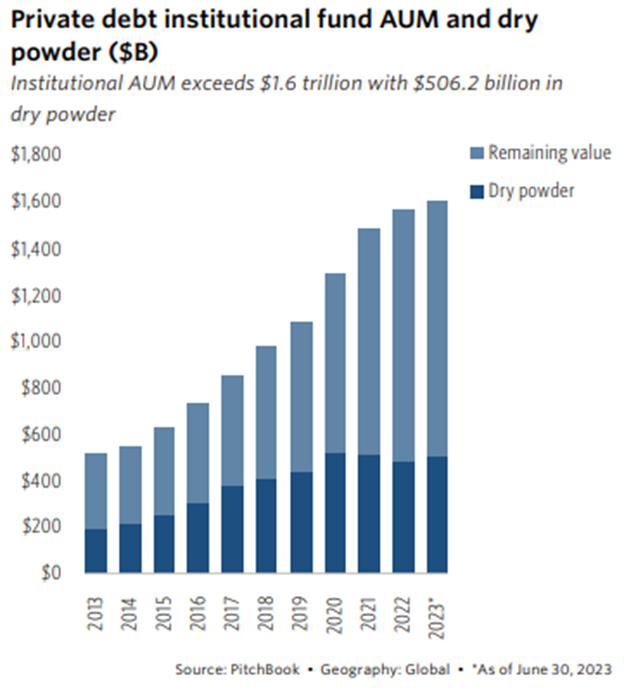

How are private credit fundraising and dry powder looking?

The next view is of private credit fundraising and dry powder. For the fourth consecutive year, private debt funds will likely exceed $200 billion for the fourth consecutive year. The first year private credit exceeded $200 billion was in the pandemic-cash era of 2020 at $212 billion. Fundraising reached its all-time high of $288 billion in 2021, then dropping to $229 billion in 2022 and $191 billion in 2023.

Switching to the dry powder view, the next figure has an accounting of the dry powder picture. Amazingly, dry powder is almost a third of all assets under management of $506 billion ($1.6 trillion in assets under management).

Summing Up

Overall, 2023 was a good year for private credit. Given that interest rates are likely to change in 2024 and 2025, it will be worth watching to see what happens with interest in private credit funds over the coming two years. Will private credit be able to continue to provide a good return to investors with lower interest rates? Perhaps – and it depends on how investors view risk and the potential return of competing asset classes in relation to private credit.

Comments on this entry are closed.