Every quarter, private equity and venture capital data provider Pitchbook releases their accounting of the state of the venture capital and private equity markets. The recently released second quarter valuations picture offered some surprising glimpses. Here’s a look.

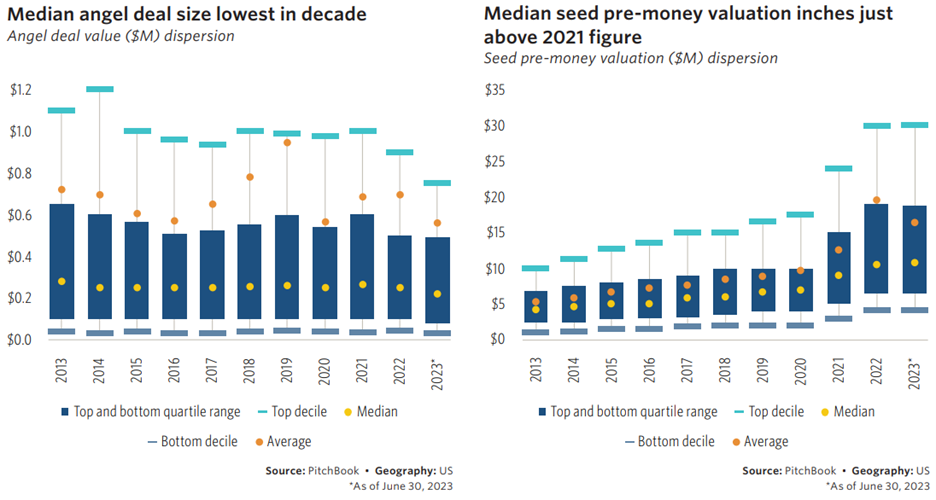

Angel and seed valuations

The first look below is of angel and seed valuations. The figure on the right, which shows median and average pre-money valuations over the past decade, offers a surprisingly positive view. In what would be an expert-busting result, median seed value pre-seed grew in the second quarter of 2023, with median pre-money valuation coming in at about $9 million. The median valuation has consistently grown over the past decade. Of course, on a less than positive note, the average deal value declined in the second quarter, coming off an historically high average deal value of almost $20 million.

Shifting to the figure on the left, median angel deal size is the lowest in a decade. This view is completely unsurprising given the nature of the economy and interest rates. The median deal size dropped to around $200,000, with the average dropping to around $500,000. This suggests that investors want to continue to make deals – especially the deals they’ve backed in the past but are getting nervous about how things might turn out.

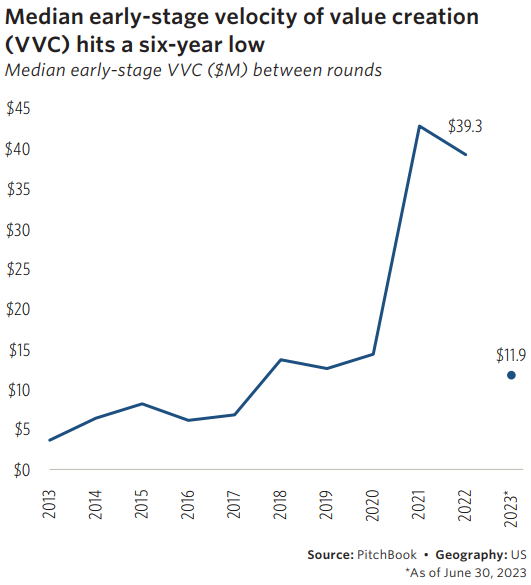

A concerning view from the velocity of value creation

The next view offers a concerning view. It is the median early-stage velocity of value creation. On the net, by this measure, value creation has slowed – and by a lot. The median early-stage velocity of value creation hit a six-year low of $11.9 million (median) through the first half of 2023. That’s down from the peak of $39.3 million in 2021. So, by some measures, venture capital and private equity markets are doing fine. By other measures, the picture is not so positive.

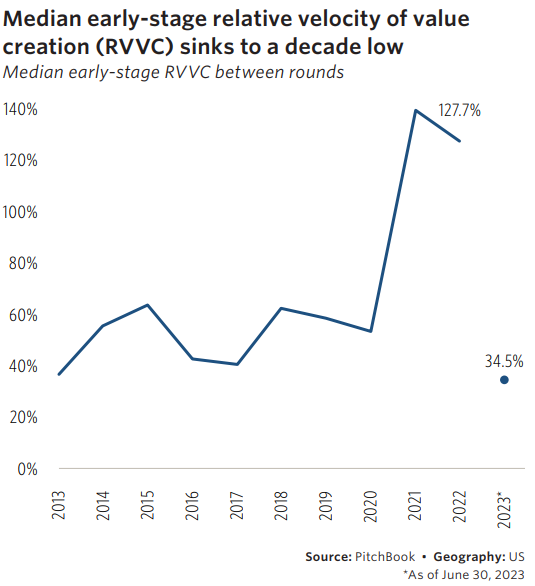

Looking at the relative velocity of value creation

The last view is of the median early-stage relative velocity of value creation. By this measure, the picture is less than bright. Amazingly, median early-stage relative velocity of value declined from a peak of 127.7% in 2021 to a decade low of 34.5% in the first half of 2023. This suggests that perhaps the valuation increases in the intermediate aftermath of the global pandemic were a bit too much, and that one should not expect any sort of astronomically quick value creation again. Perhaps never again.

Summing Up

Overall, in a surprising level of confidence, venture capital valuations are holding up very well. With the economy likely to enter some hard patches in the coming months, time will tell if valuations can continue to surprise on the upside.

Comments on this entry are closed.