Every potential investor in private equity funds has the question: Does the past performance of private equity (PE) funds predict future performance? According to a recent research note out of PE research firm Pitchbook, the answer to that question is probably, but it depends. Here’s a review.

Some Background

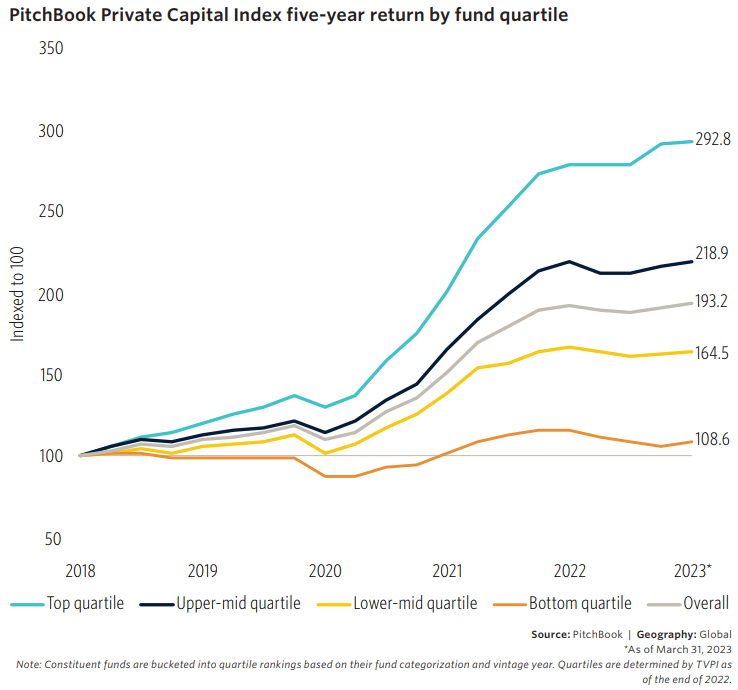

As background, the following is a look at Pitchbook’s Private Capital Index five-year return by fund quartile. Overall, the top tier funds – the top 20th percentile of funds – produced paper returns of 192.8 percent. The next best performing group of funds – the Upper-mid quartile – saw paper returns of 118.9 percent. The Lower-mid quartile and the Bottom quartile of funds saw returns of 64.5 percent and 8.6 percent, respectively. The overall return, highlighted with the gray line, saw returns of 93.2 percent.

What Does the Past Performance Picture Look Like?

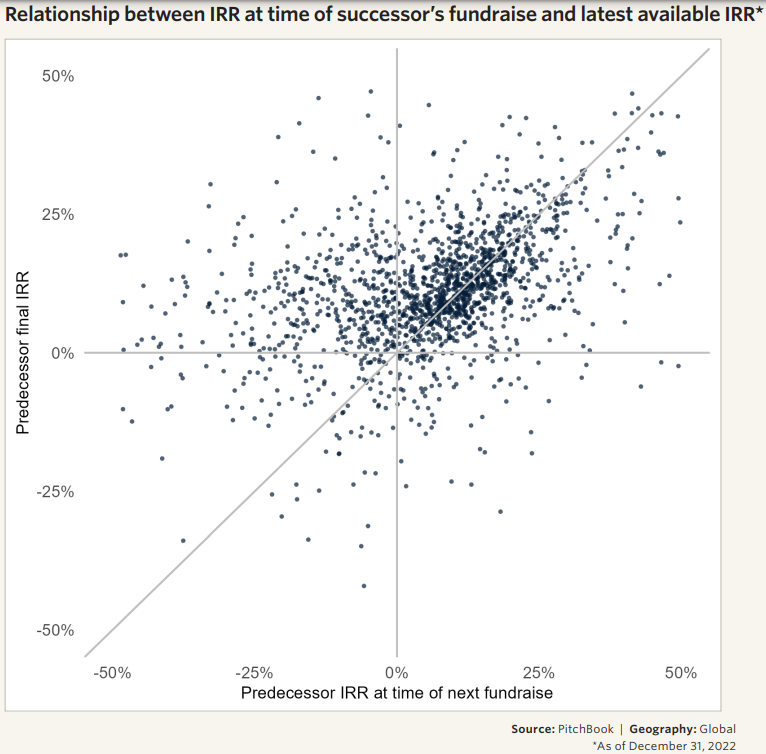

Next, let’s shift our attention to the relationship between the internal rate of return (IRR) at the time of the successor’s fundraise and the latest available IRR. Interestingly, the relationship is strongly connected in a positive manner. What this means is that, according to Pitchbook’s research, past return of a fund manager’s prior fund is a predictor of future returns of a fund manager’s future funds.

Question: Given this finding, why wouldn’t bottom tier investment firms simply copy the strategies of the top returning mangers until the return differences peter out? Think about that when considering the idea that star mangers from years prior can continue to be star managers in the future.

Breaking Down the Connection

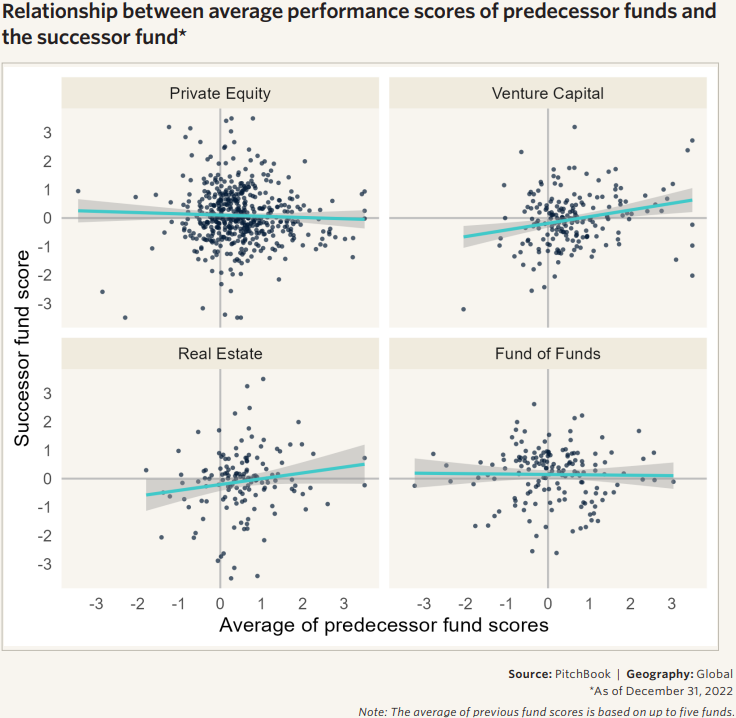

The final figure presented here, from Pitchbook’s research note, breaks down the relationship between average performance scores of predecessor funds and the successor fund.

Fascinatingly, in contrast to the prior finding on the broad definition of private equity, the following figure shows that for funds that focus on investing that can be defined as traditional private equity, past return had almost no relationship with future fund returns.

In contrast, venture capital funds showed a relatively modest connection between the two. Interesting, huh?

Also interesting is that real estate funds had a moderately positive relationship between past returns and future returns, but Fund of Funds companies exhibited no staying power between past returns and future returns.

Hmmmm.

Summing Up

In an interesting research note, private equity data provider Pitchbook argued that past return can sometimes be a prelude to future returns on a broad view. Although contrary to the popular Efficient Markets Hypothesis for public investing markets, the idea may have some validity in the broad private equity sphere. When breaking down the return picture by detailed investing sector, the evidence becomes much less clear on any connection between past returns and future returns. In any event, for future private equity investors, the argument is fairly clear on a broad level – put money with the best managers of the past. This offers the best chance to maximize your private equity return. This may sometimes be true.

Comments on this entry are closed.