In a fascinating review of what they call the “Unicorn Baby Boom and Bust”, private equity data provider Pitchbook recently released a study on what happened to the unicorn boom in 2022. Here’s a review.

The Unicorn Boom and Bust from a Broad View

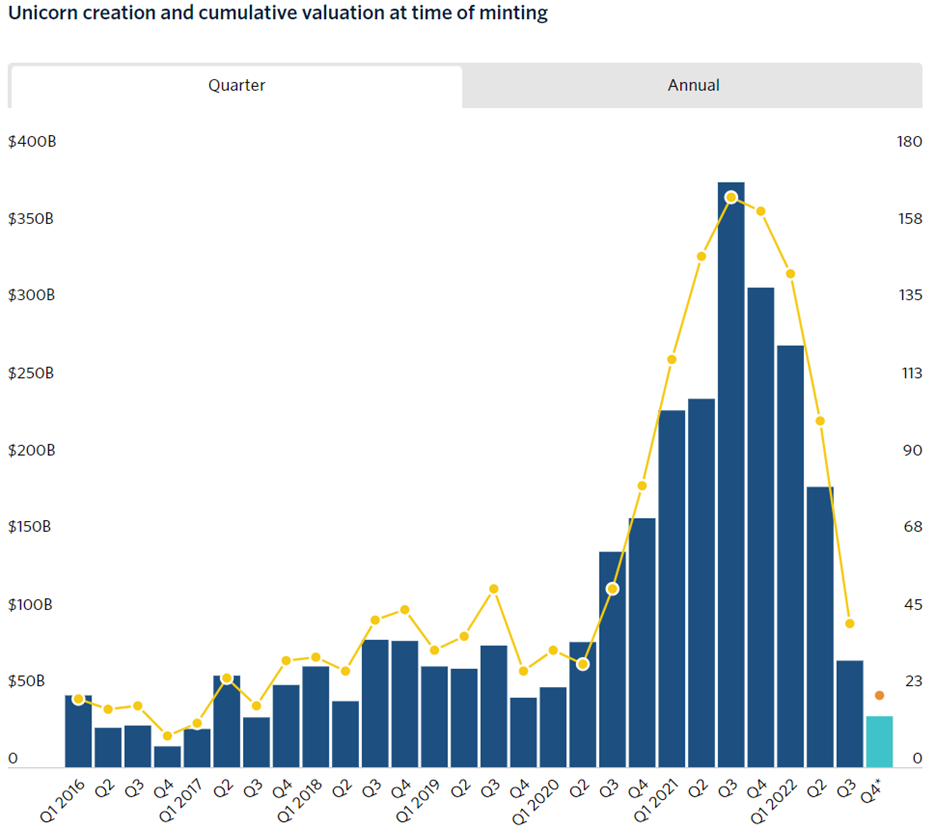

The first chart put out by Pitchbook is the unicorn creation and cumulative valuation at time of minting. The figure shows a massive rise in both cumulative valuation and unicorn counts beginning in the second quarter of 2020.

Overall, from the second quarter of 2020 to the peak in the third quarter of 2021, unicorns’ cumulative valuations went from $81 billion to $379 billion. On counting the number of unicorns, the count of unicorns ballooned from 30 to 166 over the same period. Simply amazing! (And it goes to show you what simple money printing will do to asset prices :)).

Following the third quarter of 2021 peak, the decline has been precipitous. On cumulative valuation, unicorns’ values have dropped from the $379 billion peak to a fourth quarter of 2022 low of $33 billion. That’s a decline $346 billion over the course of a little over one year, or about 91%. On the unicorn counts, the decline has been just as awe-inspiring. Unicorn counts went from 166 in the third quarter of 2021 to 21 at the end of 2022.

If there’s one lesson to learn from this, it’s that financial activity and their associated valuations can turn on a dime. So, be vigilant.

Source: Pitchbook

Source: Pitchbook

Notable Unicorns

With this background, it’s still important to note that unicorn activity was still reasonable by historic standards. Some of the more notable unicorns of 2022 are shown in following table (provided by Pitchbook).

On top of the notable unicorn list is KuCoin, a cryptocurrency, blockchain, and fintech company headquartered in Seychelles with total amount of venture capital money raised to date of $180 million for a valuation of $10 billion.

The second noted unicorn is SumUp, with total amount of venture capital money raised to date of $692 million on a valuation of $8.2 billion.

Rounding out the top three is GAC Aion, headquartered in China. The company has raised almost $3 billion in venture capital to date on a valuation of $14.4 billion.

Other members of Pitchbook’s list include The Boring Company, Relex, Trade Republic, Hui Sheng Bio-Pharmaceutical, Qonto, Lendable, and SonarSource.

Source: Pitchbook

Source: Pitchbook

Summing Up

Overall, unicorn deal activity slowed to a crawl in 2022 following enormous growth in valuations and counts over the course of the COVID-19 pandemic. The unicorn world appears to have come back to earth, with 2022 activity more aligned with most of its history. Time will tell whether the 2023 year will provide a rebound from the decline or more of a cruising altitude moderation in activity.

Comments on this entry are closed.