Every now and then, we take a look at the performance of real assets. Now seems like a good time to take a look given the recent coverage of paper assets and the potential for investors to move towards more real assets allocations. Here’s a look based upon the most recent review put out by private equity data provider Pitchbook.

An Overview

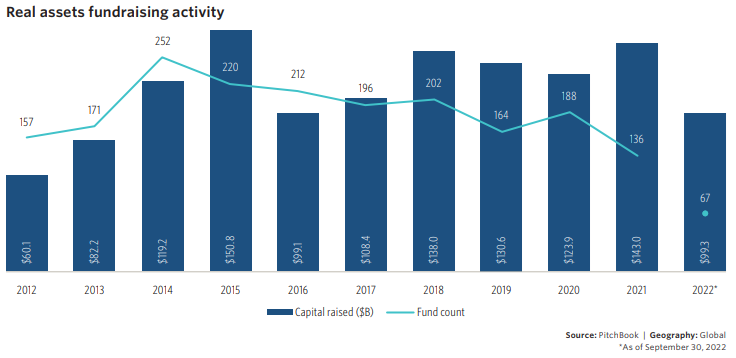

Before delving into the detail, here’s a view of the overall activity in the real assets space. Overall, through the third quarter of 2022, fundraising activity for the real assets sector has been relatively decent, with total capital raised of $993 billion over 67 funds. If this trend continues through the fourth quarter, total capital raised may reached the third highest ever at over $1.3 trillion raised across around 85 funds. By reference, the biggest years for the real asset space were 2015 and 2021, where total capital raised reached $151 billion (220 funds) and $143 billion (136 funds).

Source: Pitchbook

Source: Pitchbook

Median Step-Up

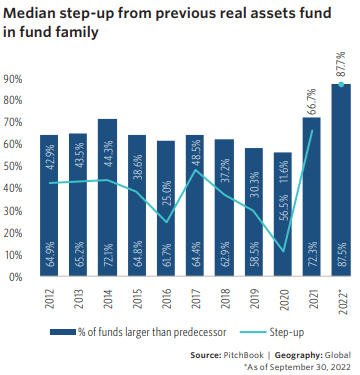

Shifting to another view of the real assets world, the following graph from Pitchbook shows the median step-up from previous real assets fund in fund family. Overall, so far through three quarters of the 2022 year, the figures have been astounding. Through three quarters, the percentage of funds larger than their predecessor is 87.5, with the median step-up a whopping 87.7%. These two measures are well ahead of prior years, with the most recent year high – seen in 2021 – of 72.3% of funds larger than their processor and 66.7% having experienced a predecessor. The world is changing in the real assets sector.

Source: Pitchbook

Source: Pitchbook

Share of Real Assets Fund Capital Raised by the Size of the Bucket

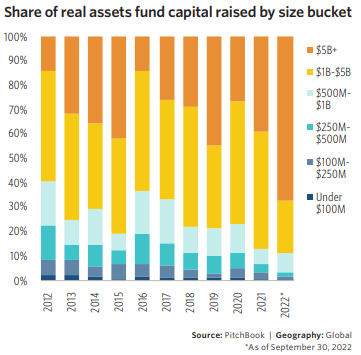

The next view is the share of real assets fund capital raised by the size of the bucket. Overall, through the first three quarters of 2022, the shift to the largest fund sizes has been enormous, much larger than any previous year. As of the end of September 2022, the percentage of real assets fund capital raised by funds with $5 billion or more captured almost 70% of all capital, well ahead of the prior high of around 55% in 2019. In 2021, the share of real assets raised by the largest funds was about 35%. When looking at the next largest group of funds – those with assets between $1 billion and $5 billion – it has captured about 20% of capital raised. Given these figures, it’s amazing that the smallest funds – those with assets less than $1 billion – survived in 2020 on the 10% left of money allocated to real assets. For one reason or another, real asset investors preferred bigger managers over smaller ones in 2022.

Source: Pitchbook

Source: Pitchbook

Summing Up

Overall, the real assets space has been doing well through the first three quarters of 2022. The outlook is less certain given the weakness in fundraising across most other asset classes, but as of now, life is still good to be a manager raising capital in the sector.

Comments on this entry are closed.