In recent years, the private equity (PE) and venture capital (VC) markets have held up relatively well. When interest rates began to rise in March 2022, some observers suggested that the PE and VC markets were in for a world of hurt. Although cracks have appeared through the past three years, the cracks have been nowhere near big enough to swallow the market. With that said, valuations are nowhere near their peak heading into the end of 2023’s first quarter. Here’s a review, according to private equity data provider Pitchbook’s 2023 Annual Valuations Report.

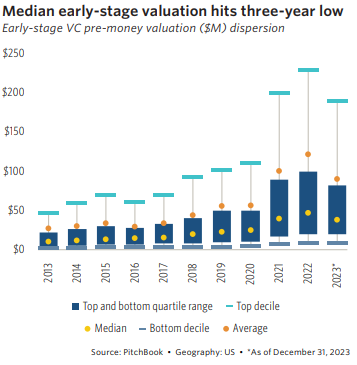

Median Early-Stage Valuation

The first look below is of the median early-stage valuation. The blue horizontal line represents the top decile (the top 10 percent). The orange dot represents the average. The yellow dot represents the median valuation. The blue bars represent the top and bottom quartile range. Overall, according to the median or average, valuations decline in 2022, from around $50 million (median) to around $25 million (median). For the average, the decline was less stark, dropping from around $120 million to around $80 million.

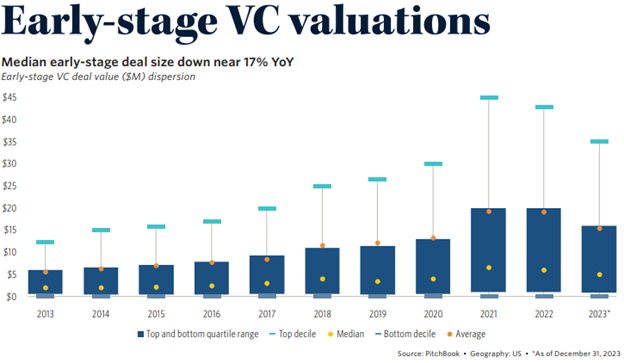

Median Early-Stage Deal Size

The next look is of the median early-stage deal size from 2013 through 2023. Overall, median deal size declined again in 2023 to around $15 million. Median deal size peaked in 2021 at almost $20 million. In 2022, median deal size was down only slightly compared to 2021. When measured by where deal sizes have been over the prior 10 years, the 17 percent year over year decline is less stark. In fact, if one were to draw a simple line from 2013 to 2023, the 2023 deal size value is still higher than what that line would predict, suggesting that, although deal sizes are becoming smaller, there’s still a healthy amount of gain built into the market compared to the pre-pandemic environment. The pandemic changed some things – some significantly – and early-stage valuations are one of them.

Median Step-Up Declines to a Decade Low

Lastly, the following figure is the median step-up from 2018 through 2023. Overall, the median step-up fell to a decade low in 2023 to around 1.5x. In contrast, the peak was reached in the first quarter of 2021 at an amazing 3.5x. The decline suggests some weakness in the viability of some early-stage valuations.

Summing Up

Overall, the private equity and venture capital markets continue to move through relatively challenging economic times. Although higher interest rates have put a damper on valuations, the industry continues moving forward with deals, and valuations – although down from their 2022 peaks – and still healthy relative to where valuations have been in the past 10 years. Time will tell what the docket holds in 2024 for early-stage investors.

Comments on this entry are closed.