How is the Global Pre-Seed World Doing?

According to some, investment in the pre-seed world is a harbinger of things to come. In this vein, private equity data provider Pitchbook recently released an interesting new dataset on the pre-seed investing world. Here’s a look.

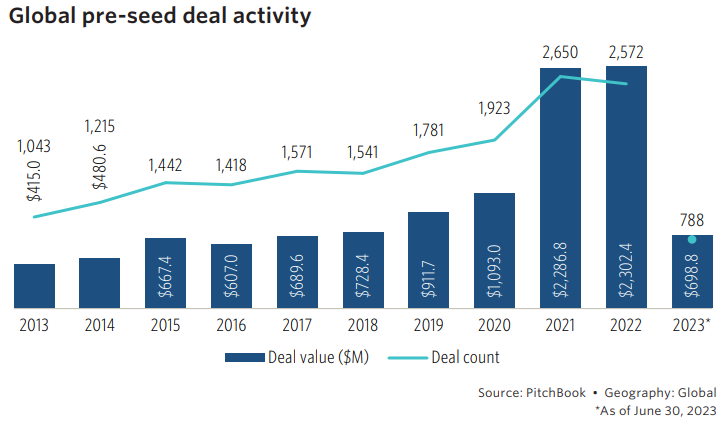

The Global Picture

The first view is that of the global picture of pre-seed deal activity. Compared to 2021 and 2022, the first half of 2023 has not been great, with total deal value coming in at an estimated $699 million across 788 deals. That is a far cry from the full year deal values of $2.29 billion in 2021 and $2.30 billion in 2022. There were also many more deals in 2021 and 2022 at 2,650 and 2,572, respectively.

When looking over the longer period since 2013, global deal activity looks ok. If the first half of 2023 repeats in the second half, 2023 pre-seed deal activity will surpass activity in the prior years – except 2021 and 2022 – and by a large amount. The next largest year would be 2020 at $1.09 billion and 2019 at $912 million.

What is perhaps most striking is how enormous the rise has been for pre-seed deals. In 2013, total deal value was just $415 million across 1,043 deals. What a difference a decade can make.

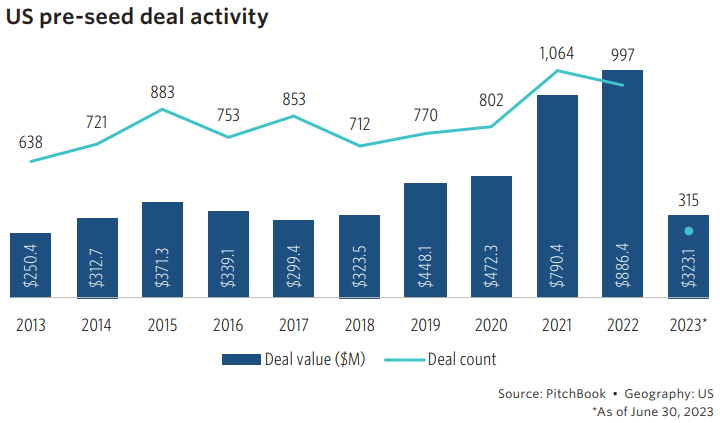

U.S. pre-seed deal activity

The next view is the U.S. picture. At $323 million through the first six months, the U.S. pre-seed deal picture is still quite healthy. The peak, when measured by deal value, for U.S. pre-seed deal activity was in 2022 at $886 million across 997 deals. The peak for number of deals was in 2021 at 1,064. Overall, pre-seed deal value has seen healthy growth over the past decade, with the 2013 value at just $250 million.

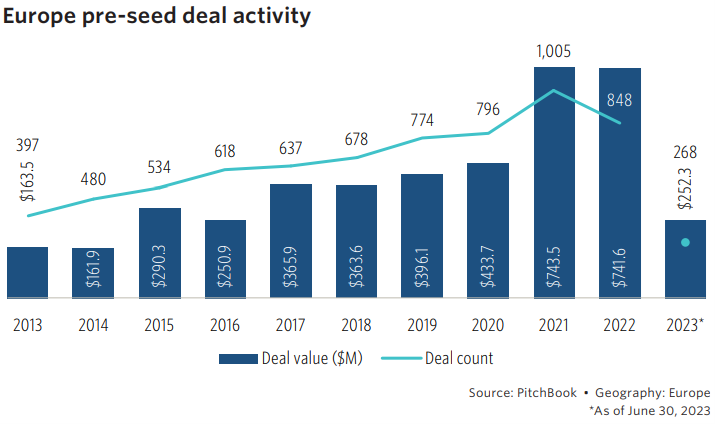

Europe pre-seed deal activity

The third view is of the European continent. Overall, as with the U.S., conditions are weaker in 2023 compared to 2021 and 2022, but still healthy by historical measures. At $252 million through the first six months of 2023, Europe pre-seed deal activity is on course to surpass the 2020 deal activity level of $434 million.

Summing Up

Overall, pre-seed deal activity across the world is slower in 2023 than in 2021 or 2022, and by a large amount. With that said, 2023 deal activity will still surpass all previous yearly totals, suggesting that conditions are simply slowing to reasonable levels rather than collapsing. Pre-seed deal activity is simply normalizing at a healthy level.

Comments on this entry are closed.