Who are the Top 10 Buyout Families?

Every now and then, private equity data provider Pitchbook puts out an interesting take on who they view are the top buyout groups. Although it is not the final say on which buyout groups are in the top 10, it usually offers some interesting insight into an “insiders” point of view. Here’s a look.

First, the Data Points That Defined the Method

Before delving into Pitchbook’s method for ranking fund manager performance in the buyout arena, here’s some background on what counted and what didn’t when deriving the rankings. The analysts at Pitchbook used their proprietary manager performance scoring system, which rates funds raised by a single general partner based on reported returns, funds raised, assets under management, timing of returns to limited partners, dispersion in returns, and the relative uncertainty in each fund’s internal rate of return figures. And with that explanation, here’s Pitchbook’s list in reverse order from number 10 to the very top – number one.

Number 10

Coming in at number 10 is Sentinel Capital Partners. The New York-based private equity firm saw its first fund close in 1996 and reports seven flagship funds that operate in the lower-middle market private equity universe. The fund’s last final close was $4.4 billion and has $10 billion in assets under management.

Number 9

In the number 9 slot is Accel-KKR Capital Partners. The firm focuses on software and tech-enabled services, in particular founder-owned businesses. It’s last close value was $4.4 billion, has $14 billion in assets under management, and its most recent vintage fund was in 2023.

Number 8

Number 8, with a performance score of 75, is Thoma Bravo Fund. The tech-focused investor puts its money into large software and technology companies. The firm has $127 billion in assets under management and its last final close was $24.3 billion.

Number 7

In the seventh slot is Incline Equity Partners. The firm has $5.3 billion in assets under management and focuses on valued-added distribution networks companies.

Number 6

Rounding out the top of the bottom of the top 10 is Carousel Capital Partners. The firm invests in the Southeast region, has $1.5 billion in assets under management, and has a particular focus on consumer and healthcare services industries.

Number 5

The first member in the top 5 at number 5 is Platinum Equity Capital Partners. The firm has $47 billion in assets under management and targets firms with an enterprise value of between $100 million and $10 billion. Not sure you’d actually consider that a useful range to mention, buy hey, in the private equity world, anything goes. (Not really)

Number 4

In the fourth spot is Riverside Micro-Cap Fund. The firm focuses on businesses with EBITDA under $10 million.

Number 3

In third place is Hudson Ferry Capital Fund. Based in Stamford, Connecticut, the firm invests in manufacturers, outsourcing providers, and business service companies with enterprise values between $15 and $50 million.

Number 2

The runner up in second place is Clarion Investors. The firm, with $1.9 billion in assets under management, is currently raising its fourth flagship fund.

Number 1

And the number 1 fund according to Pitchbook is Monomoy Capital Partners. With $2.9 billion in assets under management, Monomoy invests in middle-market companies within the industrial and consumer sectors of North America.

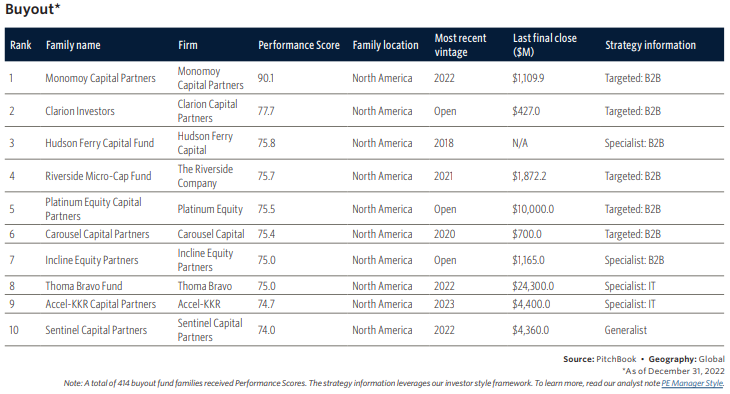

The Summary Graph

The following is a summary view of the top 10 with their associated performance score, family location, most recent vintage, last final close, and strategy information.

Summing Up

Overall, the buyout world has seen some incredible (and some not so) performance in the past decade, with some firms rising to the top. Economic conditions, of course, were responsible for some of the backdrop, as were individual skills in selection and advisement, and perhaps a little luck. The coming decade will give watchers even more insight into the skills of buyout families as the economic backdrop will likely be nowhere near as favorable as the past 10 years. Time and the coming evidence will tell.

Comments on this entry are closed.