The past year has been just okay for the private equity world. Deals and fundraising continued, albeit at slower paces than in 2021 and 2022, but nonstop concerns about the health the economy continued to dog private equity activity.

There are bright spots, though. Here’s a review of where private equity (PE) stands as of the end of June 2023.

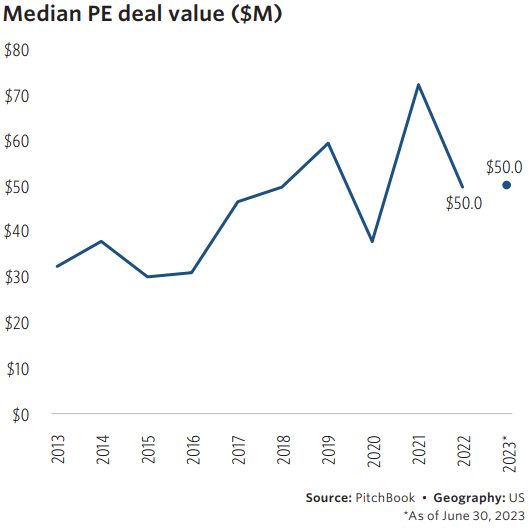

Median PE Deal Value

The first look below is the median PE deal value from 2013 through the second quarter of 2023. Overall, median deal value generally trended upward until 2021. The 2021 peak was followed by prolonged weakness at around $50 million. The current median PE deal value now stands at $50 million. Is the weakness over? Or are we seeing a PE dead cat bounce?

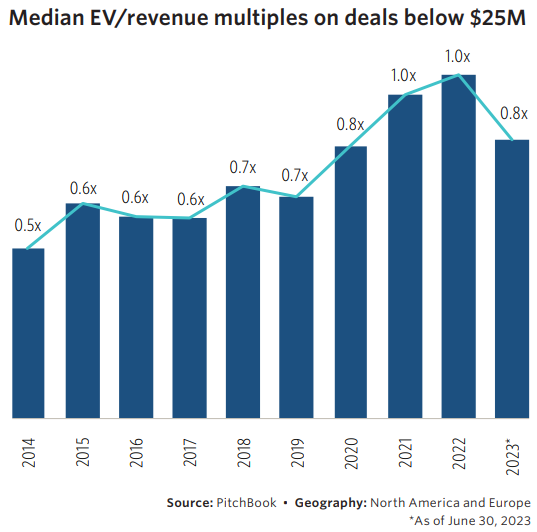

Median EV/Revenue Multiples on Deals Under $25 Million

The next view is the median enterprise value (EV) per dollar of revenue multiple for deals valued at $25 million or less. Interestingly, for the first time since 2019, the median EV/Revenue multiple is down through the first half of 2023 to 0.8x, or about 20 percent from its 1.0x in 2022 and 2021. Of note, the 0.8x is still above where it was in the years shown – 2014 through 2019 – and points to the argument that perhaps PE has simply gone through a breather rather than a correction. Time will tell.

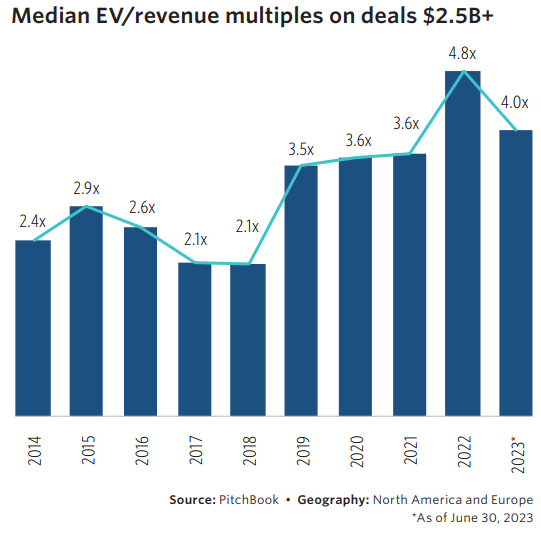

Median EV/Revenue Multiples for the Large Deals

The next view is of the median EV value per dollar of revenue multiple for the large deals – defined as anything with a value of $2.5 billion or above. Interestingly, multiples for the large deals are down as well. As shown in the following graphic, median EV/Revenue multiples are down to 4.0x, down from 4.8x in 2022. It’s worth noting that, according to Pitchbook, the 2023 multiples through the first half of 2023 still put multiples above all prior years with the exception of 2022. So, the PE economic picture is not as bad as some might suggest. Of course, global economic conditions have yet to turn south.

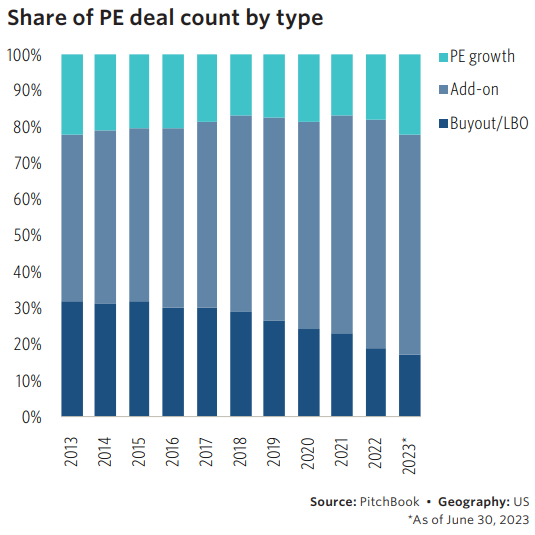

Share of PE Deal County by Type

The last view here is of PE deal count by type of activity. Interestingly, Buyout/LBO activity has had is smallest share of the pie ever through the first half of 2023, suggesting that higher interest rates are having an effect. On the opposite end, Add-ons continue to gain a greater share of the PE deal count activity.

Summing Up

Overall, PE deal activity has at least gone through a slower period in the past year. Recent activity suggests PE activity is picking up, although this could just be a minor revival from the breather, with more weakness ahead. Economic conditions will, undoubtedly, have a large role to play in how PE performs in the coming quarters.

Comments on this entry are closed.