If you’ve been reading media reports in recent weeks, you’re likely well aware that there’s a lot of interest in generative AI (artificial intelligence). The name describes the broader analytical methods of machines, in a way, learning to mimic human thinking (as measured by their texts put out on the web).

Question: With all the interest in AI, do you think the venture capital and private equity world would be booming in generative AI investments?

Interestingly, the answer to this question is, as of now, no. Here’s a look according to data provided by private equity data provider Pitchbook.

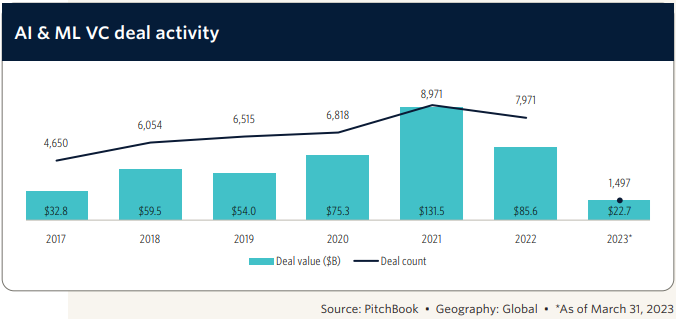

Artificial Intelligence and Machine Learning Venture Capital Deal Activity

The first look below is of artificial intelligence (AI) and machine learning (ML) venture capital (VC) deal activity from 2017 through the first quarter of 2023. Does anything stand out?

Perhaps the most intriguing finding is that venture capital deal activity in the AI and ML space is relatively unmoved – slightly declining on an annualized basis – since 2021. In 2021, the number of AI and ML VC deals reached a peak of 8,971 with an estimated deal value of $131.5 billion. Activity cooled in 2022 to 7,971 deals and $85.6 billion in value. So far through the first quarter of 2023, the number of deals continue to weaken at 1,497 and a deal value of just $22.7 billion. Surprising?

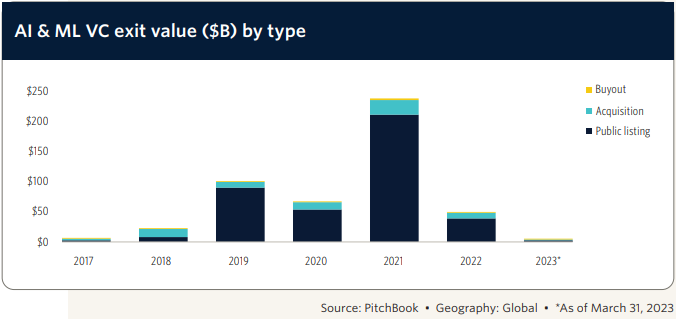

Artificial Intelligence and Machine Learning Venture Capital Exit Value by Type

The next view is of AI and ML venture capital exit value by type. The 2021 year was massive, with almost $250 billion in exit value across Buyout, Acquisition, and Public Listings. Conditions softened considerably in 2022, with total exit value less than $50 billion. And things are not looking any better in 2023, with almost nothing having occurred through the first three months of this year.

It is worth noting that most of the exit value has been through Public Listings as opposed to Buyouts or Acquisitions. Interesting?

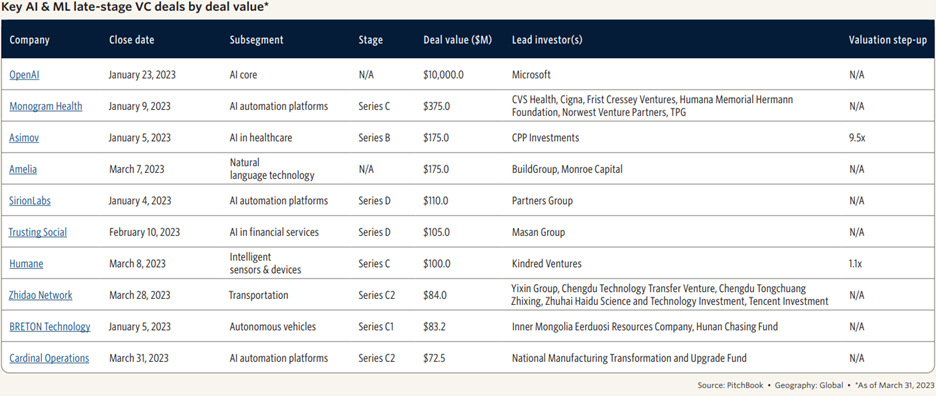

Some Key Deals

Lastly, the following table looks at some of the key AI and ML deals across the VC space. The largest one of the deals shown is likely no surprise given the incredible attention paid to ChatGPT. OpenAI secured $10 billion in funding, mostly from tech behemoth Microsoft, which apparently has invested heavily in the technology and the OpenAI organization.

Summing Up

Overall, although ChatGPT and artificial intelligence have gained a lot of attention recently, there is little evidence that the media’s attention to so-called generative AI has led to an increase in investment in the investing world. That may change in the coming years, but as of now, venture capital and private equity investors are still a little gun shy on getting into the generative AI universe.

Comments on this entry are closed.