How did the different sectors of the private markets do in 2022? And how does the 2022 performance compare to prior years? Here’s a look.

The Overall Picture

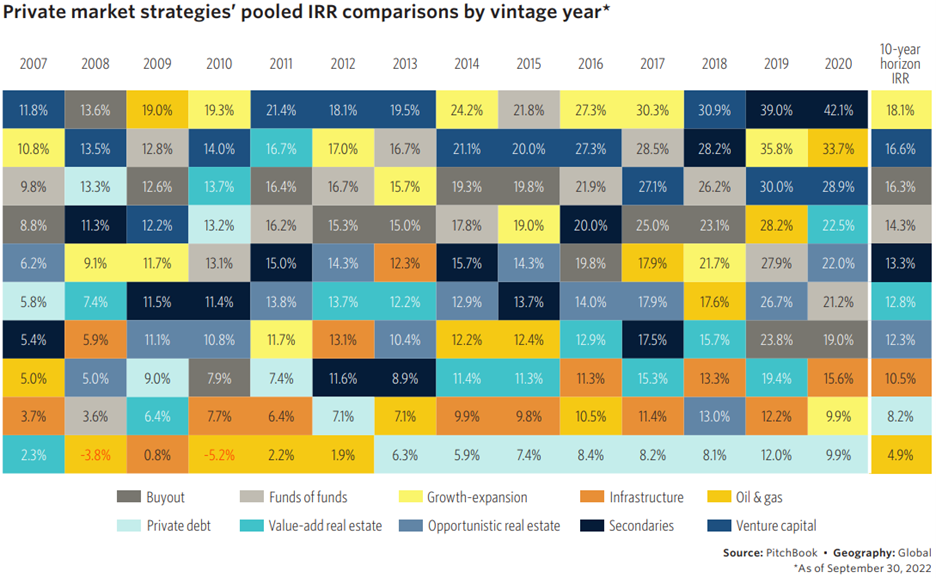

The following figure from private equity data provider Pitchbook shows the performance of 10 private market strategies from 2007 through 2020 by vintage year. Which strategy won over the 10-year horizon, as measured by the horizon IRR (internal rate of return) (remember, vintage year)? Interesting, Growth-expansion came in first at 18.1%. In second and third places were Venture capital at 16.6% and Buyout at 16.3%. On the other end, the weakest performing strategies were Infrastructure at 10.5%, Private debt at 8.2%, and Oil & gas at 4.9%.

Interestingly, of the 14 years shown, Growth-expansion has come in first for four of those years –the second most of any of the competing strategies. Which strategy has had five years on top? Perhaps unsurprisingly, Venture capital, with wins in 2007, 2011, 2012, 2013, and 2018.

Now, shifting to the weakest performing strategies, one of the ten strategies has come in on bottom for eight of the 14 years. Which strategy is that? Private debt. From 2013 to 2020, private debt came out on bottom. Why? The main reason was simply historically low interest rates, which made it difficult for private debt to produce competitive returns with the other strategies.

Another View: One Year Rolling IRRs

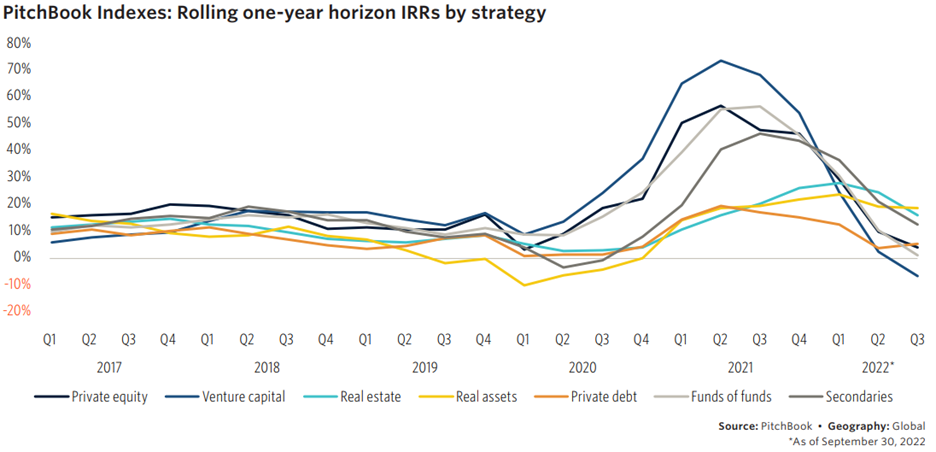

The following figure presents another view of the strategies according to the one-year horizon IRRs. Interestingly, the top strategy from this view was Real assets, followed by Real estate and Secondaries.

At the bottom end is, quite surprisingly, Private equity and Fund of funds (the Fund of funds results are somewhat unsurprising given the fees imposed by the strategy).

A Third View: Private Capital Funds Horizon IRRs by Strategy

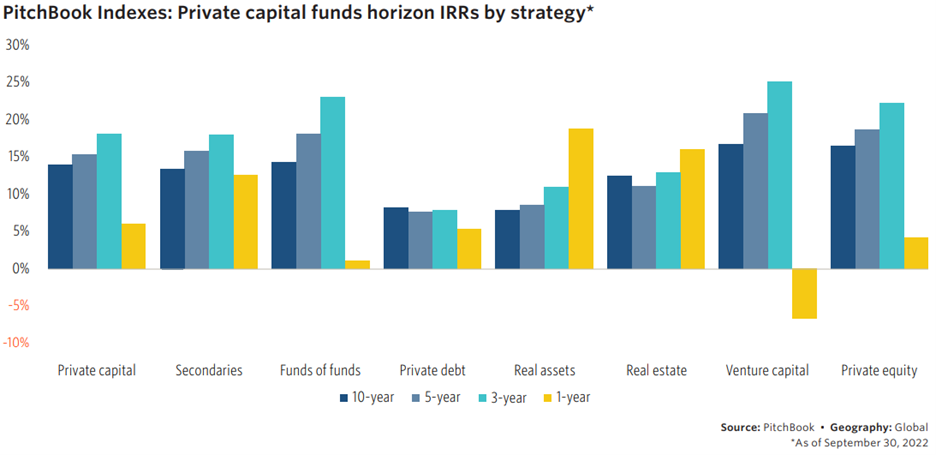

The third view presented here is the private capital funds horizon IRRs by strategy. The shift is a return from the 10-year, 5-year, 3-year and the 1-year is quite surprising. For example, the IRR for Venture capital shifts from increasingly positive to the strongest negative over the 1-year horizon. With the exception of Real assets and Real estate, all strategies exhibit a decline in IRR when shifting to the 1-year horizon.

Summing Up

Overall, the private markets saw some surprising results in 2022 – at least when viewed by sector returns. Given the historical volatility in sector returns, 2023 is shaping up to be just as intriguing.

Comments on this entry are closed.