Every quarter private equity data provider Pitchbook releases their accounting of the global equity league tables. Their accounting of the most globally active, most active in the U.S., and the most active in the non-U.S. part of the world is often fascinating. Here’s a review.

The U.S. View

The first view presented below is the U.S. view. On top of the list is Ares Management with 27 deals under their belt in the first three months of 2023. Seven deals behind Ares’ leadership was Audax Group at 20 deals. Rounding out the top five were Shore Capital Partners (16 deals), HarbourVest Partners (15 deals), and The Carlyle Group (15 deals).

The bottom five of the top ten included Atlas Partners (14 deals), BHMS Investments (14 deals), New Mountain Capital (13 deals), Charlesbank Capital Partners (13 deals), and Riverside Company (13 deals).

Source: Pitchbook

Source: Pitchbook

The Rest of the World View

Shifting the view to the rest of the world, the top player was Kohlberg Kravis Roberts at 7 deals, followed by Trivest Partners at 6 and Temasek Holdings at 6. Four firms came in with 5 deals in the first quarter, including TA Associates Management, Accel-KKR, OMERS Private Equity, and Motilal Oswal Private Equity. Rounding out the top 10 were eight firms with 4 deals, including Yulin Coal Conversion Fund, MediaNet Partners, Warburg Pincus, Intermediate Capital Group, Advent International, Creador, Oaktree Capital Management, and Canadian Business Growth Fund.

Source: Pitchbook

Source: Pitchbook

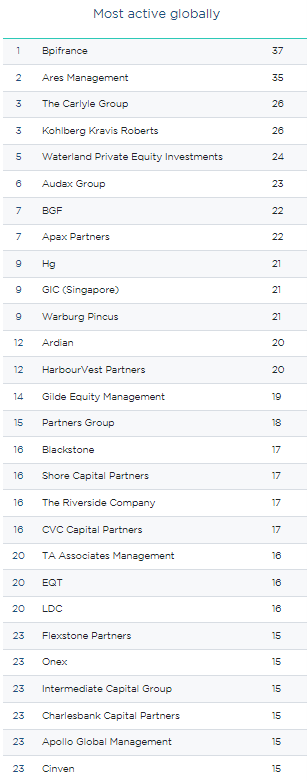

The Global View

Lastly, shifting to the most active investors globally. Tops on the list was Bpifrance at a whopping 37 deals. Not far behind Bpifrance’s leadership was Ares Management at 35 deals. Tied for third place at 26 deals apiece were The Carlyle Group and Kohlberg Kravis Roberts. Rounding out the top five was Waterland Private Equity Investments at 24. The bottom half of the top 10 included Audax Group (23 deals), BGF (22 deals), Apax Partners (22 deals), Hg (21 deals), GIC (Singapore) (21 deals), and Warburg Pincus (21 deals). Other notable mentions with 18 deals or more included Ardian (20 deals), HarbourVest Partners (20 deals), Glide Equity Management (19 deals), and Partners Group (18 deals).

Source: Pitchbook

Source: Pitchbook

Summing Up

Overall, many of the world’s most well-known investors are still on the top of the Global league tables, with U.S. firms continuing to place close to the top. The private equity universe is still chugging along, perhaps at a slower pace than in prior years, but deals are still being made as evidenced by the continued healthy deal counts.

Comments on this entry are closed.