In the consumer world, there is no more important issue of the day than inflation. Its effects show up in everything – including decisions about venture capital and private equity investing. Where is inflation hottest? Where is it cooling? Here’s a look.

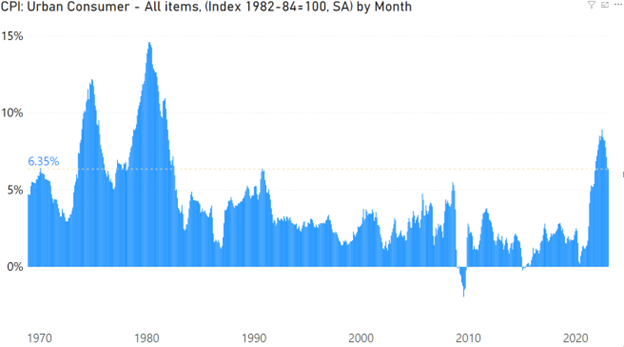

Overall Inflation

The first look is of the overall inflation picture. The most recent Consumer Price Index measure came in at +6.35% year-over-year. This is a deceleration from the 8.93% in June 2022. Clearly, disinflation is the storyline, or is it?

What should concern investors is a peek back at the 1970s. In the 1970s, the American economy went through three waves of inflation. The first peaked in February 1970. The second started in late summer 1972 and peaked in November 1974. The third inflation run-up began at the end of 1976 at 5% and accelerated all the way to a peak of 14.6% in March 1980. A very unpleasant experience for most everyone involved (unless, of course, you happened to have purchased some of the 30-year government bonds that paid a 30% rate!). If the 1970s is the guide, then we have two more painful spurts ahead of us. Ugh.

The Details

Given this background, which areas are showing the greatest inflation rates? Here’s a review.

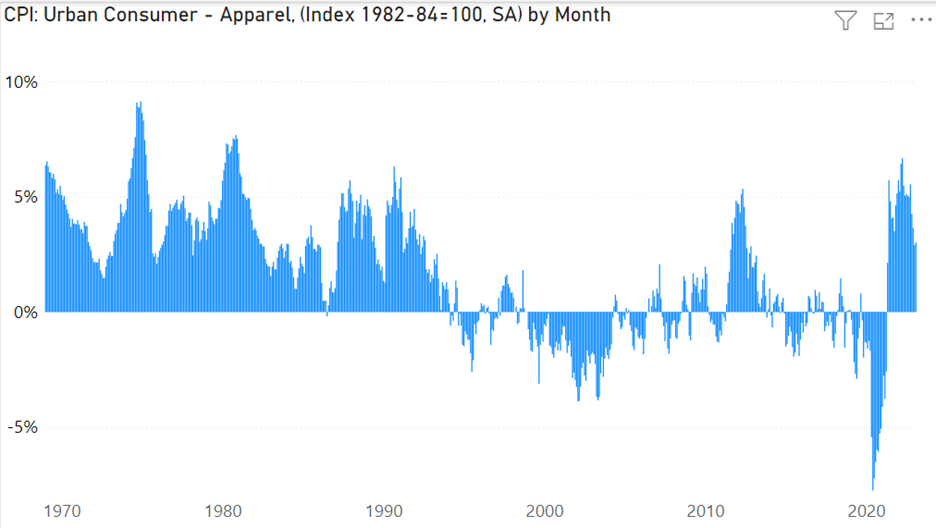

Up first is apparel. Overall, apparel inflation continues to drop quickly, with the most recent estimate at just 3% year-over-year. This is unsurprising given that apparel has been under intense competition for many years.

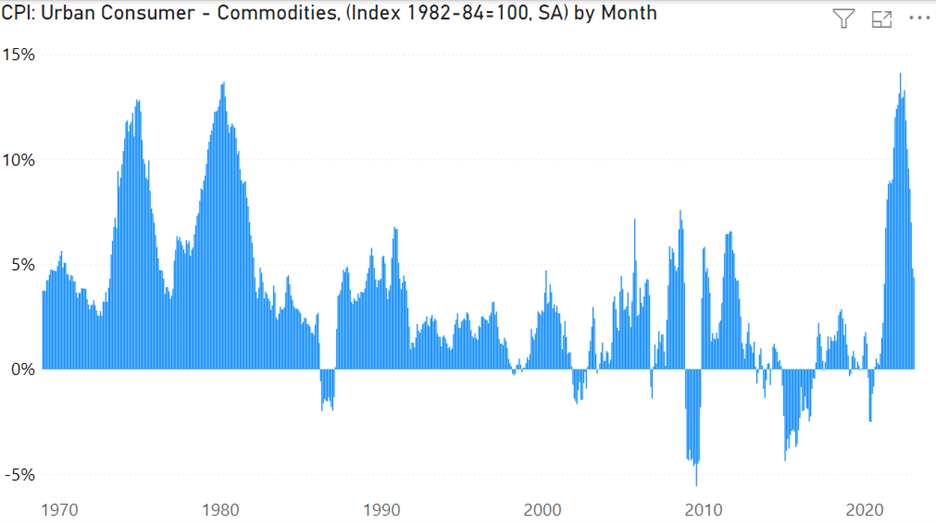

The next look is of commodities. Commodities were a big contributor to the astonishing run in inflation in 2022, with commodities peaking at 14.1% year-over-year in March 2022. The most recent was 4.4%.

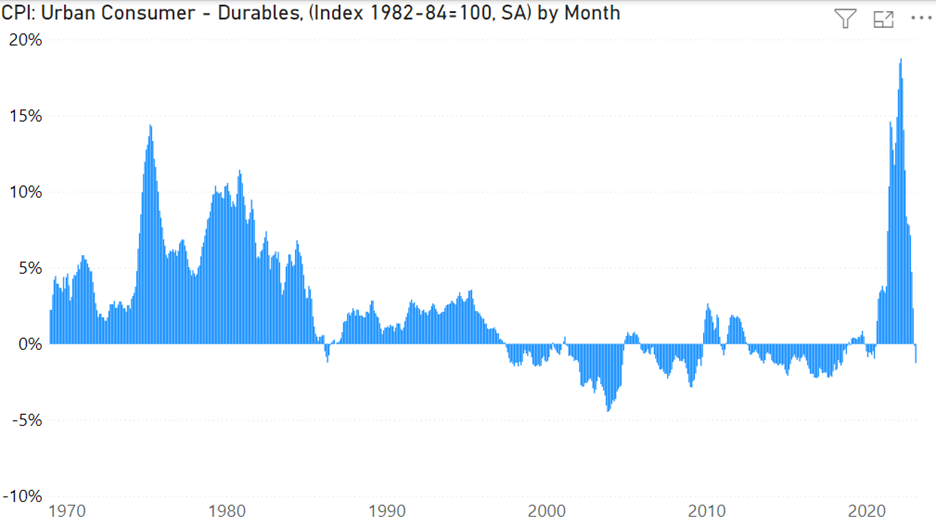

The next look is of durable goods. In a potentially positive signal, the most recent estimate of year-over-year inflation for consumer durables was down 1.3%. The measure peaked in February 2022 at 18.8% year-over-year.

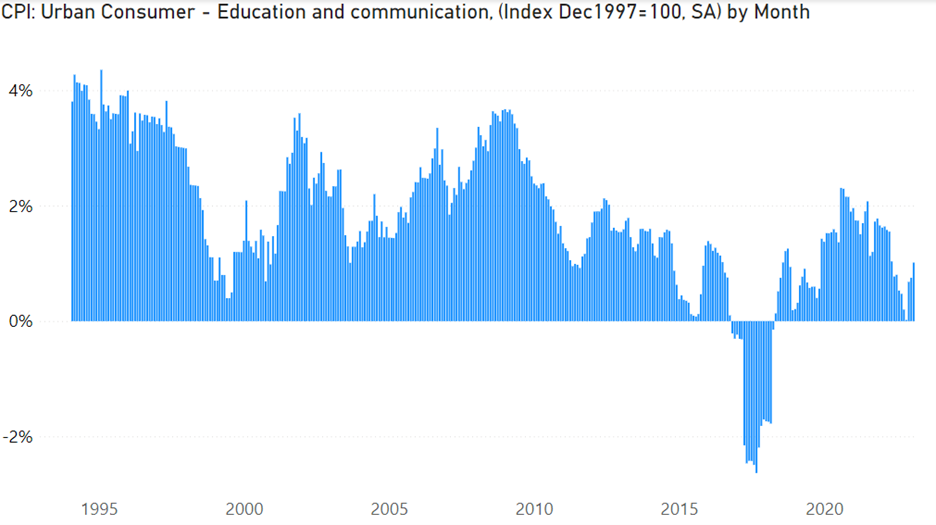

The next look is of education and communication. The measure bottomed in September 2022 at 0.2%. Since then, education and communication inflation has accelerated to 1.0%. Not bad compared to other measures, although heading in the wrong direction.

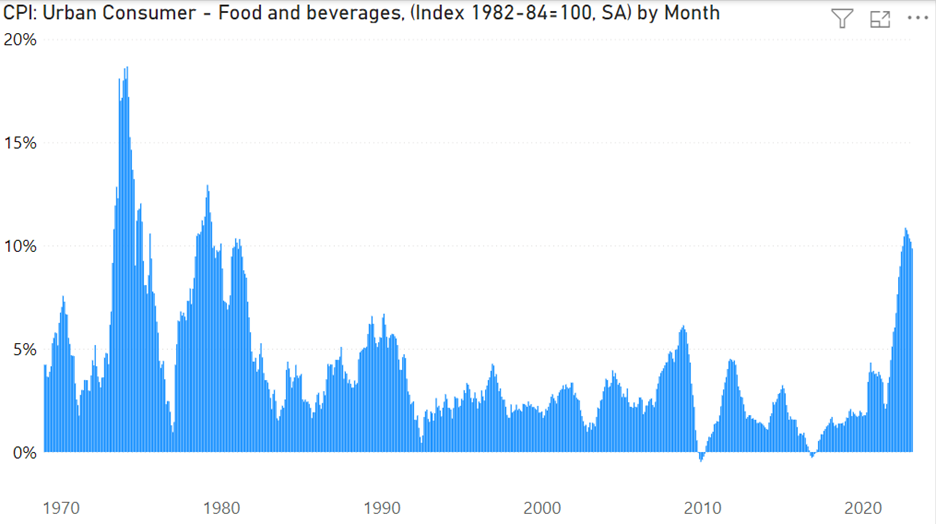

The following shows the picture for food and beverage inflation. This measure has been consistently high, with the most recent estimate at 9.9% in January 2023.

Summing Up

Overall, by some measures, inflation in the U.S. is slowing while by other measures, inflation concerns are far from receding. The 2023 year will provide an interesting perspective on the supply and demand imbalance that is at least partially at the heart of the inflation picture.

Comments on this entry are closed.