Private equity data provider Pitchbook is out with a fascinating new look at firms’ patent portfolios and venture capital funding.Here’s a review of the new research.

Patent Seeking Firms

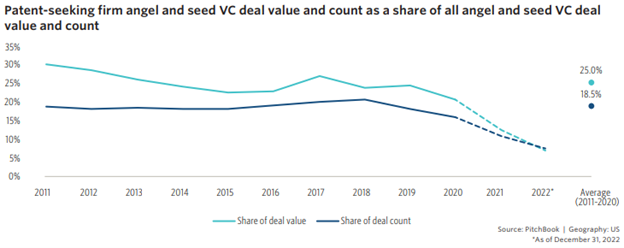

The first view shown below is patent-seeking angel and seed venture capital (VC) deal value and count as a share of all angel and seed VC deal value and count. Interestingly, and perhaps surprisingly, the share of deal value (light blue line) has floated between 30% in 2011 to around 20% in 2020. In 2022, the measure reached a low of about 10% of all deal values. One might think that the opposite trend would appear in the data given the increasing importance of patents.

When shifting to the share of deal count view (dark blue), a similar trend shows up, with the surprising dip in recent years for patent seeking firms. Overall, though, startups seeking patents raise more capital than their non-patent seeking peers, with about 58% of VC funding going to startups with patents or with patent applications.

Why would there be a downward trend in 2021 and 2022? Perhaps the most obvious reason is that patent applications may not be publicly disclosed until 18 months after filing. Pitchbook notes this as a disclaimer of caution for the 2021 and 2022 data.

The Late-Stage VC Picture is Different

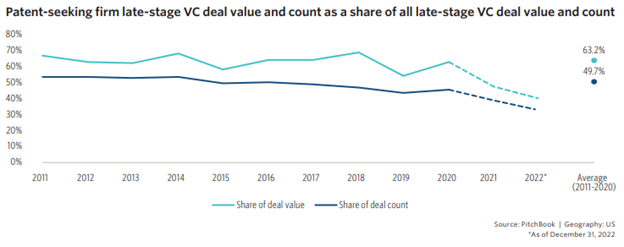

As one might expect, the late-stage VC picture is quite different. As shown in the following figure, patent-seeking firm late-stage VC deal value and count as a share of all late-stage VC deal value and count have floated from a high of almost 70% to a recent low of about 58% for the share of deal value. When looking at the share of deal count, the measure has dropped from a high of around 55% to a recent low of about 40%. As noted above, when the lag in available patent data is available, the trend will likely reverse itself somewhat, although probably not entirely. The average over the years shown for the share of deal value was 63.2% and the average for the share of deal count was 49.7%.

The Absolute Count View

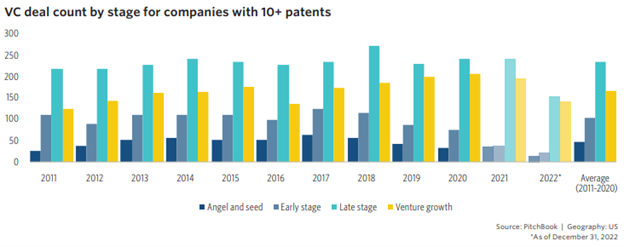

The percentage figures presented up to this point provide some context of where the patent-seeking investing world stands. The following figure looks at VC deal county by stage for companies with ten or more patents. Overall, for angel and seed stage companies, the count is consistently less than 100, while for early-stage companies, the count has generally floated around 100. For late stage and venture growth companies, counts have generally been in the 150 to 200 range, with late stage counts reaching a high of 250 in 2018 and venture growth reaching a high of about 200 in 2020.

Summing Up

Overall, recent research out of Pitchbook suggests it’s a good thing to be a patent-seeking early-stage company. Patent-seeking firms tend to draw more interest from professional investors, and there appears to be growing interest in very early stage companies’ interest in pursuing patent applications. Time will tell if these statements continue to be true.

Comments on this entry are closed.