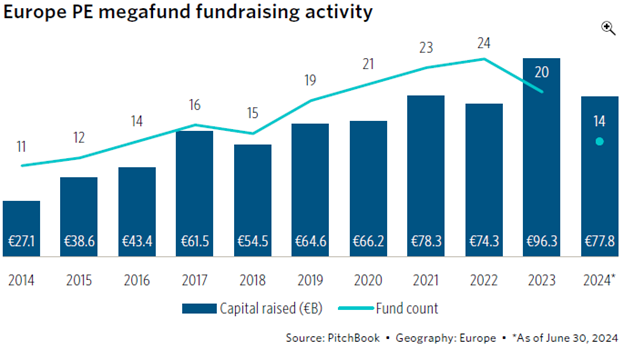

In recent years, European megafunds have emerged as a dominant force in the private equity (PE) landscape, marking a notable shift in the fundraising and investment dynamics across Europe. Despite facing macroeconomic challenges, European megafunds have been setting new fundraising records, reflecting the growing appeal of large-scale investments within the region. The second installment of PitchBook’s analyst note on the rise of European megafunds delves into the factors driving this trend, comparing megafunds to non-megafunds in terms of timelines, step-ups, and overall performance. Here’s a review according to a recent report out of Pitchbook.

Fundraising Trends and Shorter Timelines

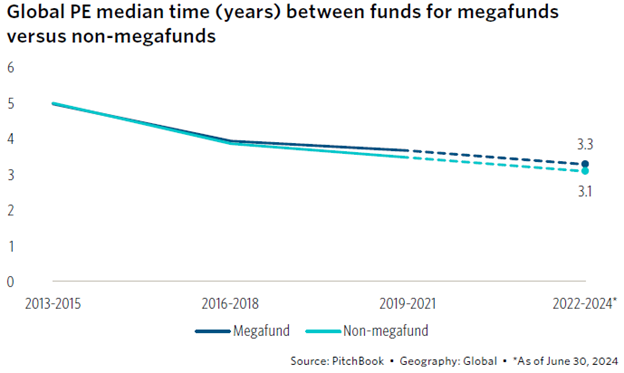

One of the most notable developments is the reduced time between fundraising rounds for megafunds. Between 2013 and 2024, the median time between fundraising cycles for European megafunds decreased from 5.4 years to 3.3 years. Non-megafunds followed a similar trend, though at a slower pace, with the median dropping from 5.5 years to 3.7 years. This acceleration highlights the growing investor confidence in large funds and their ability to attract capital more quickly than smaller funds.

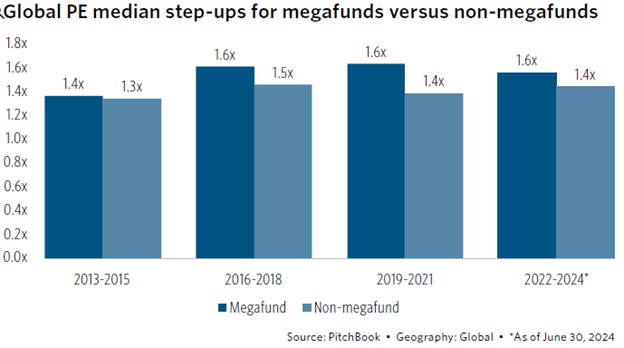

Step-ups, or the increase in capital raised from one fund to the next, have also been a key feature of megafund growth. European megafunds have consistently outpaced non-megafunds in terms of step-ups, peaking at a median of 1.8x between 2019 and 2021. However, recent economic conditions, including rising interest rates and tightening credit markets, have caused step-ups to moderate, with megafunds experiencing a slight decline to 1.6x in the 2022-2024 period. Non-megafunds, on the other hand, have maintained a steady step-up rate of 1.4x.

Longer Fundraising Timelines

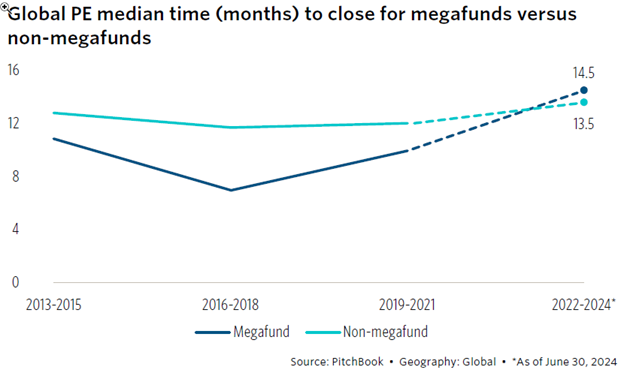

Interestingly, despite their ability to raise large sums of capital, the time to close a megafund has increased in recent years. In the 2022-2024 period, the median time for megafunds to close increased to 15 months, up from nine months in 2019-2021. This increase is attributed to the more complex nature of megafund fundraising, which often involves specialized investor relations teams and intricate fundraising strategies. Additionally, lower capital availability in recent years has further extended the time needed to close both megafunds and non-megafunds.

Cash Flow Divergence and Capital Deployment

One of the key differentiators between megafunds and non-megafunds since 2020 has been their cash flow profiles. While non-megafunds have maintained positive net cash flows, megafunds have turned cash flow negative. This divergence is largely due to the higher capital contributions required by megafunds compared to their distributions. Since 2020, European megafunds have returned approximately €250 billion to limited partners (LPs), representing 55% of total European PE fund distributions, while accounting for at least 67% of contributions. This imbalance has resulted in negative cash flows for megafunds, underscoring the pressure on these funds to deploy capital effectively in the current high-interest-rate environment.

Performance of European Megafunds

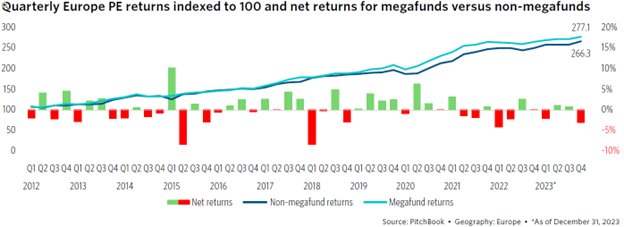

The performance of European megafunds has been a topic of debate, with some suggesting that larger funds underperform due to the challenges of scale. However, PitchBook’s data reveals that European megafunds have generally outperformed their smaller counterparts over longer time horizons. Over a 15-year period ending in 2023, megafunds achieved annualized internal rates of return (IRRs) of 12.7%, compared to 11.4% for non-megafunds. On a quarterly basis, megafunds also outperformed non-megafunds, with a marginal but consistent advantage.

Despite these positive returns, the dispersion of performance remains a key consideration for investors. Megafunds tend to offer more stable and predictable outcomes, with less extreme variations in performance between the top and bottom quartiles. This stability is attractive to LPs, particularly those seeking lower-risk investments with predictable returns.

Conclusion

Overall, the rise of European megafunds represents a notable evolution in the private equity landscape. These funds have demonstrated their ability to raise large sums of capital quickly, potentially outperform over long horizons, and offer stable returns. However, the challenges of managing such large pools of capital, particularly in a tightening economic environment, will continue to shape their future performance. As European megafunds continue to grow, they are likely to remain a focal point of private equity fundraising and investment strategies in the region.

Comments on this entry are closed.