Venture capital (VC) has long been regarded as a high-risk, high-reward domain dominated by seasoned investors and industry veterans. However, in recent years, a noteworthy trend has emerged – the startup of first-time venture capital managers. These ambitious individuals, often armed with a unique perspective and fresh ideas, have been making waves in the traditionally exclusive world of venture capital. The question here is a simple one: How are the first-time VC managers doing? Here’s a look.

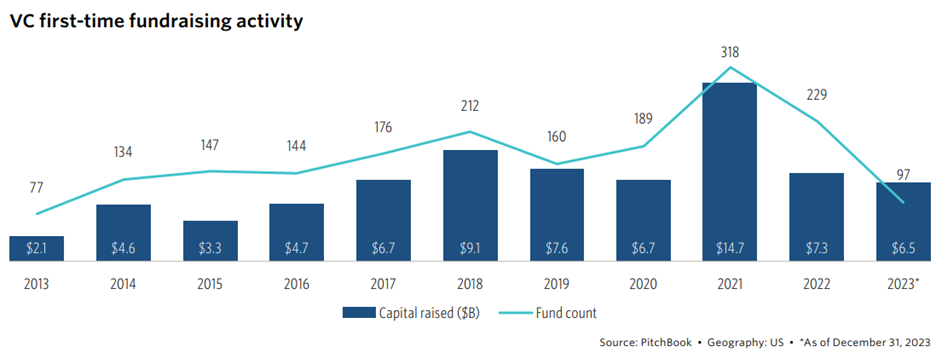

First-time Fundraising Activity

The following figure, from private equity and data provider Pitchbook, shows VC first-time fundraising activity. In 2013, Pitchbook reports $2.1 billion in capital raised across 77 funds. That figure fluctuated between $3.3 billion and $9.1 billion from 2014 through 2020. Then, in 2021, fundraising jumped to $14.7 billion across 318 funds. After the pandemic-driven rise, things went back to what some might call “normal.” In 2022 and 2023, fundraising was $7.3 billion and $6.5 billion, respectively, across 229 and 97 funds.

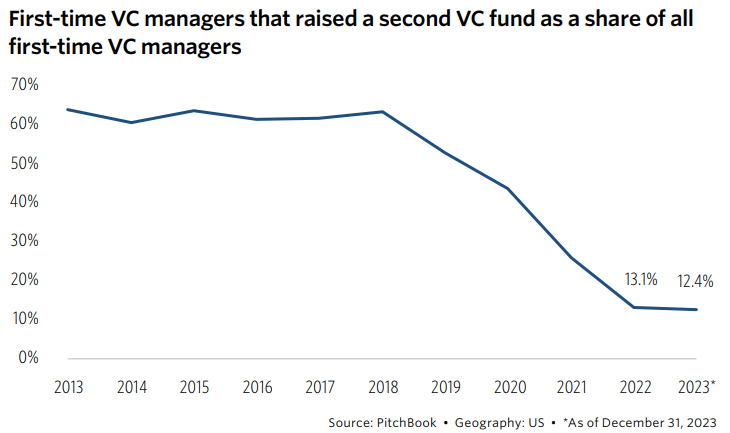

Raising a Second Fund

Given the interest in starting a VC fund, how are they doing in raising a second fund? The following has the answer according to data from Pitchbook. Overall, the answer is not particularly good in recent years. From 2013 to 2018, starting a second fund floated between 60% and 70%. Then, things went south. In 2019, the number of founders starting a second fund dropped to around 50%. In 2020, that figure dropped to below 50%. Things went lower still in 2022 and 2023, with the percentage of first-time managers raising a second fund dropping to 13.1% and 12.4%, respectively.

First-Time Mangers Bring New Perspectives and Innovation

One of the key reasons for the success of first-time managers in most any industry – venture capital included – is their ability to bring diverse perspectives and innovative thinking to the table. These individuals often come from varied backgrounds, bringing expertise from industries outside of traditional finance. The newcomers’ unconventional approach to investment decisions and risk assessment may improve returns for the industry as a whole, or then again, they may fail at such a task.

The real question one should be asking at this point is: Why? Why would first-time fund managers fail to raise a second fund? This question is more difficult to answer. Is it simply that new managers can’t beat the old guard? Is it that the nature of venture capital makes it difficult to raise money?

Conclusion

Overall, the decline in the number of first-time venture capital managers beginning second funds is, perhaps, a cause for concern for the investment landscape. Healthy industries invite the success of newcomers, even if it comes at the expense of the existing guardians of wealth. Time will tell whether the current trends will hold up in the coming years.

Comments on this entry are closed.