Every quarter, private equity data provider Pitchbook releases their accounting of the most active private equity (PE) and venture capital (VC) investors. Here’s a look at PitchBook’s Q3 2024 Global League Tables through the third quarter of 2024. In addition to covering VC and PE, the update includes mergers and acquisitions (M&A). One of the advantages of Pitchbook’s take on investor activity is their breakdown of activity across regions, sectors, size, and exits.

Private Equity Activity

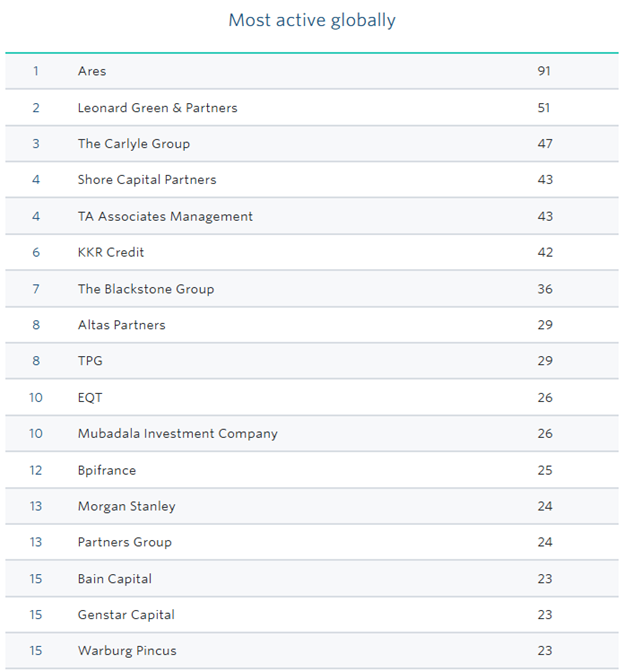

In the realm of private equity, several firms distinguished themselves in the third quarter. On top of the most globally active list includes (deals in parentheses) Ares (91), Leonard Green Partners (51), The Carlyle Group (47), Shore Capital Partners (43), and TA Associates Management (43).

Venture Capital Activity

Shifting to the VC picture, the venture capital landscape showcased robust activity, with the most active firms having actively invested in at least 30 startups and emerging companies each. On top of the list of most active VCs in the third quarter was (deals in parentheses) Antler (78), Enterprise Ireland (74), Pioneer Fund (70), Andreessen Horowitz (67), and Y Combinator (64).

Mergers and Acquisitions Activity

M&A activity remained a critical component of the global financial landscape. Pitchbook’s league tables suggests some well-known names continue to lead the world in M&A transactions. The top five list includes (deals in parentheses) Jefferies (130), BDO (80), Houlihan Lokey (80), PwC (77), and KPMG (61).

Of Note on Methodology

PitchBook’s methodology for compiling these league tables involves analyzing an extensive dataset of deals. For PE firms, regional rankings are based on all PE deal types as defined by PitchBook. Similarly, VC firm rankings consider all VC deal types. When specific deal types are broken out in rankings, such as buyouts or exits, only those deal types form the basis of the rankings. This approach ensures that the league tables accurately reflect the firms’ activities across different deal types and regions.

Conclusion

Overall, PitchBook’s Q3 2024 Global League Tables offer a detailed snapshot of the firms leading the charge in private equity, venture capital, and mergers and acquisitions. To the casual reader, these interactive rankings offer valuable insights into the global financial landscape.

Comments on this entry are closed.