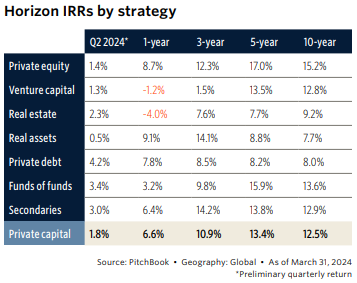

Every quarter, private equity data provider Pitchbook releases their estimates of fund performance. The recently released Q1 2024 Global Fund Performance Report provides an insight into updates on private capital strategies, highlighting challenges and opportunities across asset classes. Although the macroeconomic conditions are weak, the report offers some interesting insights into the performance of private equity.

Private Equity (PE): Navigating a New Normal

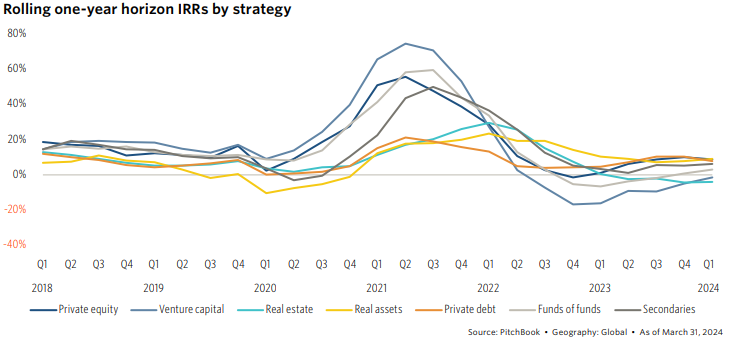

Private equity, with a one-year internal rate of return (IRR) of 8.7%, continues to perform below its historical average of 14.2%. Larger funds, particularly megafunds, outperformed their smaller counterparts, demonstrating resilience but also higher volatility due to leverage. European funds led regional performance with a 9.6% IRR, fueled by robust fundraising and increased interest from non-European investors. However, the higher-for-longer interest rate environment has kept returns in check, making it challenging for funds to recapture the exceptional performance seen in previous years.

Venture Capital (VC): Signs of Stabilization

Venture capital remained in negative territory with a one-year IRR of -1.2%, marking the seventh consecutive quarter of losses. However, the gap between smaller and larger funds narrowed, and smaller funds recorded their best performance since Q2 2022 with a modest 0.3% return. Anticipation of interest rate cuts and improvements in exit activity, such as IPOs, offer hope for recovery in the coming quarters. Cerebras’ IPO filing was a notable development, potentially signaling a shift in market dynamics.

Real Estate: A Sector Under Pressure

Private real estate was the weakest-performing asset class, with a one-year IRR of -4%, continuing a four-quarter streak of negative returns. Value-add strategies were hit hardest, posting -7.1% returns due to high leverage and interest rate pressures. Conversely, distressed funds were the sole bright spot, achieving a 2.8% IRR. Preliminary Q2 data suggests the sector may have bottomed out, with quarterly returns showing a slight improvement.

Real Assets: Infrastructure Leads the Way

Real assets recorded a robust 9.1% one-year IRR, driven by strong infrastructure performance (10.5%) and gains in metals, timber, and agriculture (10.7%). Infrastructure investments, particularly in energy transition projects, continue to attract significant capital, benefiting from government support and technological advancements. Oil and gas funds, while recovering, remain volatile due to fluctuating energy prices.

Private Debt: Consistent Performance Amid Volatility

Private debt achieved a one-year IRR of 7.8%, closely aligned with its 10-year average. Mezzanine funds led performance with a 15.3% return, while distressed and special situation funds lagged. The floating-rate structure of private debt helped mitigate risks during rising interest rates, though the sector now faces challenges as rates begin to decline.

Funds of Funds and Secondaries: Steady Gains

Funds of funds delivered a one-year return of 3.2%, lagging other asset classes but showing gradual improvement. Secondaries posted a 6.4% IRR, with European-focused funds outperforming North American counterparts. The narrowing bid-ask spreads in buyouts have boosted secondary activity, although pricing pressures remain a concern.

The Outlook

Overall, Pitchbook’s status report underscores a mixed recovery across private capital, with sectors like real assets and private debt showing strength, while others, such as VC and real estate, continue to face headwinds. As central banks ease monetary policies, the potential for recovery and recalibration in private markets remains a key theme for 2024.

Comments on this entry are closed.