Contrary to popular wisdom, through the third quarter of 2024, private equity (PE) markets continued moving forward despite some mixed performance. There are certainly some positive signs of PE revival while some continued evidence of ongoing challenges.

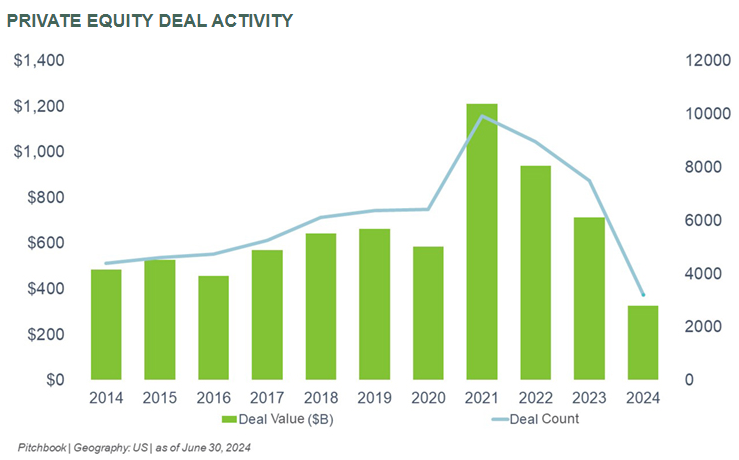

Overall, despite a slow start to the year, private equity deal-making showed some improvement, although it has not yet fully lived up to earlier expectations. By mid-2024, deal values had topped $325 billion, marking a recovery from 2023’s decline, although activity remains below pre-pandemic highs.

A Complex Landscape

The private equity market continues to navigate a complex landscape, shaped by macroeconomic factors driven by high interest rates, continued inflationary pressures, and abnormally strong but volatility in public markets. The U.S. Federal Reserve’s decision to maintain higher interest rates has strained leveraged buyouts, but deal terms are becoming more favorable due to competition among lenders. Despite no official rate cuts from the Fed, sectors as broad as technology, healthcare, and industrials have remained active, with deal volumes in these areas surpassing pre-pandemic levels.

Challenges

One significant challenge for private equity firms in 2024 has been the slowdown in exit opportunities. Public equity markets have rebounded strongly, but private company valuations have not caught up, creating a lag that has affected the pace of exits. The secondary market, including net asset value (NAV) lending and secondary transactions, has played a larger role as firms explore alternative exit strategies.

Fundraising

Fundraising has also seen improvements in some regions, particularly in the U.S., where deal-making momentum has provided optimism for a potential recovery in fundraising conditions later in the year. However, regulatory uncertainty, especially around ESG (Environmental, Social, and Governance) policies, has created additional complexities for private equity firms operating in the U.S. and Europe.

Summing Up

Overall, while private equity showed some signs of recovery in the third quarter of 2024, the market remains cautious. Deal activity has picked up in key sectors, but the higher-for-longer interest rate environment and delayed private valuations have slowed exit activity, prompting firms to seek innovative solutions to navigate these challenges.

Comments on this entry are closed.