The Initial Public Offering (IPO) market is a key indicator of economic health and business confidence. Companies often choose to go public when they expect favorable market conditions and investor appetite for new opportunities. One key macroeconomic factor that can have a significant influence on IPO activity is the Federal Funds Effective Rate (FFER), the interest rate at which banks sometimes borrow. This rate not only impacts the cost of borrowing but also influences overall liquidity in the market.

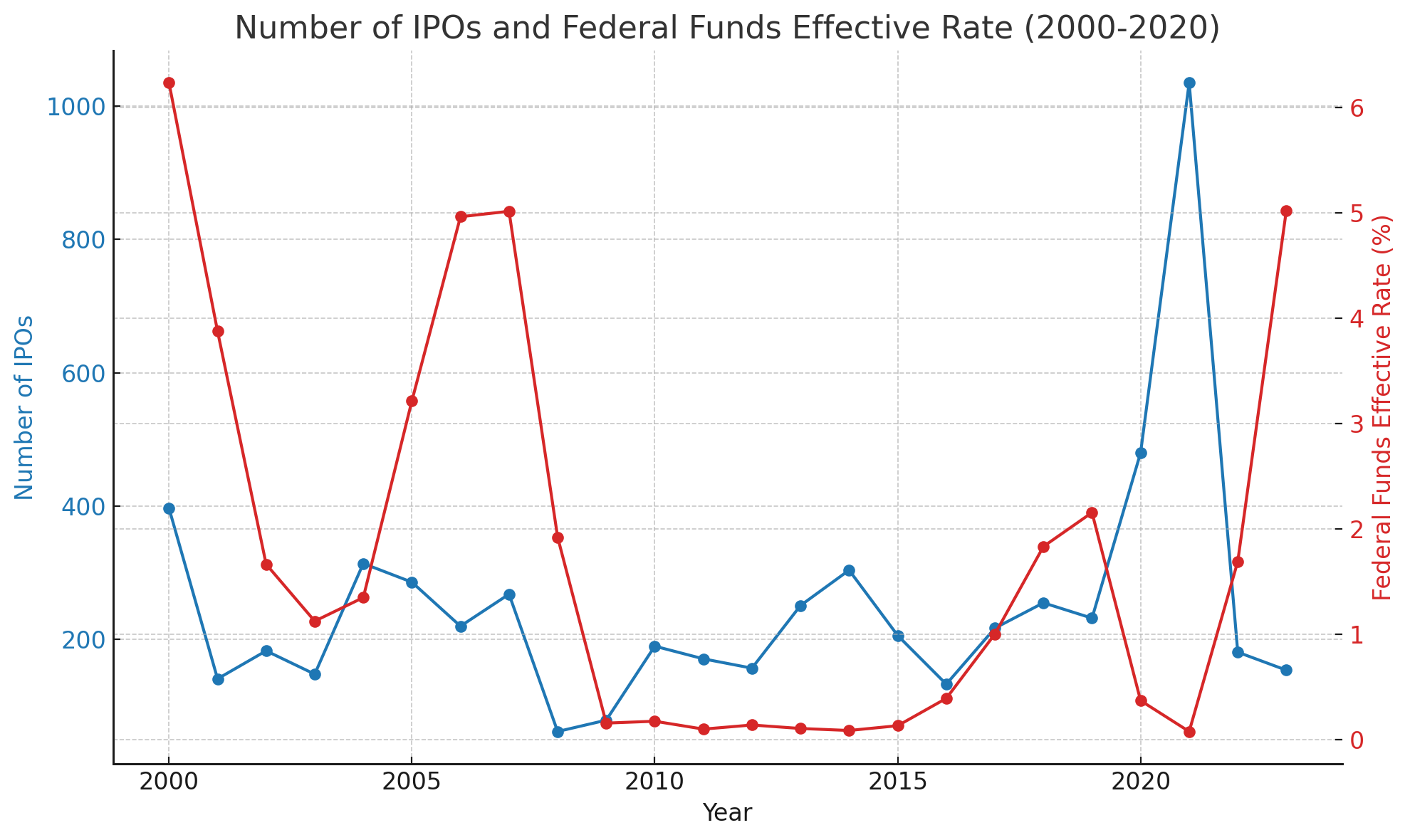

Analyzing data from 2000 to 2023, there is a notable correlation between the FFER and the number of IPOs each year. The data shows how changes in the interest rate coincide with fluctuations in IPO numbers, reflecting the direct and indirect effects the rate has on financial market conditions and corporate financing decisions.

The Link Between Interest Rates and IPO Activity

When interest rates are high, borrowing costs increase, and companies may find it more expensive to finance operations, expansions, or new ventures. This could deter companies from going public as the appetite for risk among investors diminishes, leading to fewer IPOs. On the other hand, when the Federal Reserve lowers interest rates, liquidity increases, making it easier for businesses to borrow money at lower costs, which can fuel more aggressive growth strategies, including going public.

From the early 2000s, a clear pattern emerges where the number of IPOs peaked in 2000 with 397 IPOs, coinciding with a Federal Funds Effective Rate of approximately 6.24% (annual average). However, following the burst of the dot-com bubble and the subsequent recession, both the IPO numbers and the FFER began to drop sharply. By 2001, the FFER fell to 3.88%, and the number of IPOs decreased to 141. This declining trend in IPO activity continued until 2003, when the rate reached a low of 1.12%, with only 148 IPOs during that year.

As the rate remained low for an extended period, businesses took advantage of cheaper credit, leading to a recovery in IPOs. By 2004, the number of IPOs rose to 314, while the FFER was still relatively low at 1.35%.

The Recession’s Impact and Recent Trends

The Great Recession of 2008 had a profound impact on both the financial markets and the IPO landscape. In response to the economic crisis, the Federal Reserve slashed interest rates to near-zero levels to stimulate the economy. Between 2008 and 2015, the Federal Funds Rate remained exceptionally low, which contributed to a boom in IPOs in the years following the recession as liquidity was plentiful and investor confidence rebounded.

In recent years, however, the relationship between the Federal Funds Rate and IPO activity has evolved. While lower rates still provide favorable conditions for companies to go public, other factors such as technological advancements, private funding options, and economic policy also play important roles in influencing IPO decisions.

Summing Up

Overall, will the recent rate drops provide a boost to IPOs in the coming months? Maybe, but a few months of time is likely too short. With that said, if the Federal Reserve continues on its path of lowering interest rates, we may just she another boom in IPOs.

Comments on this entry are closed.