Every quarter, private equity data provider Pitchbook offers a glimpse of the venture capital markets in Europe. Here’s a review.

Summary

Overall, this quarter’s report underscores the ongoing recovery in valuations, driven largely by favorable interest rates and the growing influence of AI across various investment stages. However, the market still grapples with uncertainties, particularly in the rationalization of valuations and the increase in down rounds, especially within the UK.

Recovery Amid Interest Rate Cuts

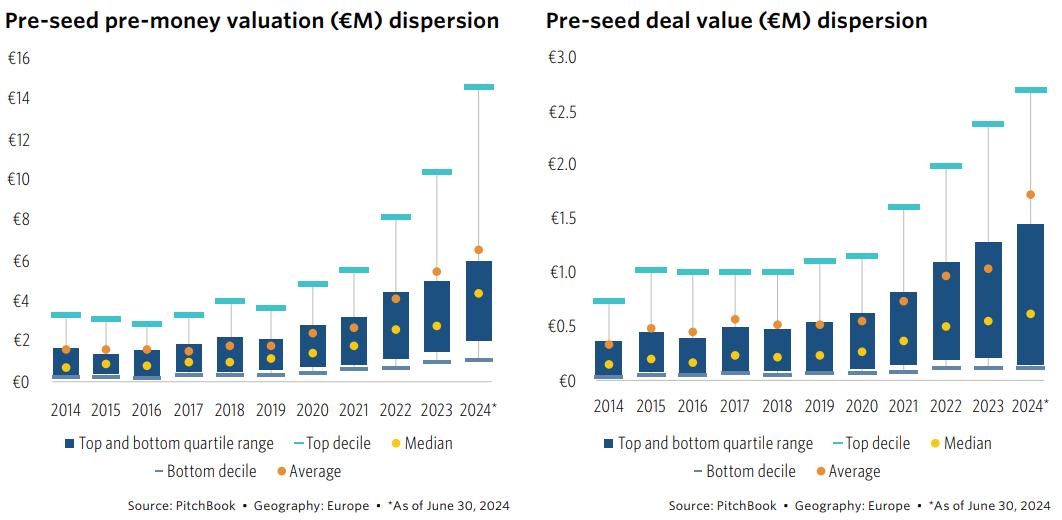

European venture capital valuations have seen a marked recovery, spurred by interest rate cuts from both the European Central Bank (ECB) and the Bank of England. This favorable monetary policy environment has provided a tailwind for early-stage investments, with pre-seed and seed stages showing the most resilience. The median pre-money valuations for these stages have notably increased, with pre-seed valuations rising from €2.8 million in 2023 to €4.4 million in Q2 2024. Early-stage deal sizes have also expanded significantly, driven by large investments in AI and fintech sectors.

The AI and Fintech Boom

AI continues to play a pivotal role in the European VC ecosystem, particularly in the early and late stages of venture capital. The median valuations in AI and fintech have seen substantial growth, reflecting investor confidence in these sectors. Fintech, in particular, has outpaced other verticals, with early-stage median deal sizes reaching €17.8 million, a significant increase from €10.4 million in 2023. Notable companies like Revolut, Monzo, and Starling have contributed to this trend, with their valuations climbing steadily throughout the year.

Challenges in Market Rationalization

Despite the positive trends, the report highlights ongoing challenges in market rationalization. The proportion of down rounds has increased to 22.9% in the first half of 2024, up from 19.9% in 2023. The UK has been particularly affected, accounting for 83.7% of these down rounds, which raises concerns about the sustainability of current valuations. This trend indicates that while recovery is underway, the market may still face headwinds, particularly in sectors that have yet to fully rationalize their valuations.

Nontraditional Investors and Unicorn Activity

Nontraditional investors (NTIs), including corporate venture capital and private equity firms, have become increasingly active in the European VC landscape. The participation of NTIs has boosted median deal values across all stages, particularly in larger rounds involving higher-valued companies. The share of deals involving NTIs reached 39.4% in the first half of 2024, nearing the peak participation seen in 2022. Unicorn activity also showed signs of recovery, with deal value in Q2 2024 reaching €2.4 billion, a significant increase from €1.0 billion in Q1. However, the median deal size for unicorns has decreased, indicating a potential shift in market dynamics as more companies return to the cap table for additional funding.

Regional Disparities

The report also sheds light on regional disparities within the European VC ecosystem. Israel emerged as a leader in early-stage deal sizes, driven by significant investments in cybersecurity, AI, and healthtech. In contrast, the UK and Ireland lagged behind other key ecosystems, with early-stage median deal sizes at €1.2 million, well below the levels seen in other regions like DACH and France & Benelux. This divergence highlights the varying levels of maturity and investor confidence across different European markets.

Summing Up

In conclusion, the Q2 2024 European VC Valuations Report paints a complex picture of recovery, growth, and ongoing challenges within the European venture capital market. While interest rate cuts and the rise of AI and fintech have driven valuations upward, the increase in down rounds and regional disparities suggest that the market is still navigating a delicate balance between optimism and caution. As the year progresses, the sustainability of these trends will likely depend on the broader economic environment and the ability of key sectors to continue attracting investor interest.

Comments on this entry are closed.