Every year, private equity data provider Pitchbook releases its accounting of the best global managers. This year’s 2023 report provides a fascinating review of the landscape. Here’s a review.

Methodology and Scoring

Overall, the 2023 PitchBook Global Manager Performance Score League Tables report provides a comprehensive evaluation of private capital fund strategies worldwide. The report ranks the historical performance of fund families managed by general partners (GPs), offering a more nuanced and robust measurement than traditional methods like internal rate of return (IRR) quartiles.

PitchBook’s proprietary methodology is central to the report’s rankings. The Performance Scores are calculated at the fund family level, reflecting the aggregate performance across multiple funds rather than a single fund. This approach is crucial because it allows the scores to encapsulate the overall strategy and team performance of a fund manager, providing potential limited partners (LPs) with a more holistic view of a GP’s track record.

The scoring system considers the dispersion of returns and the uncertainty associated with IRR figures, which are influenced by factors like fund age and the proportion of distributions already made to LPs. This method contrasts with the traditional quartile ranking system, which often oversimplifies performance comparisons by ignoring the variability and finality of returns.

Scores are standardized on a 0 to 100 scale, where 50 represents a neutral performance. The distribution of these scores across 2,182 fund families managed by 1,577 GPs shows that the top quartile begins at a score of 58.3, and the top decile starts at 66.2. This scoring allows for more precise comparisons across fund families with different vintage years and strategies, offering transparency and comparability that traditional benchmarks lack.

Global Rankings

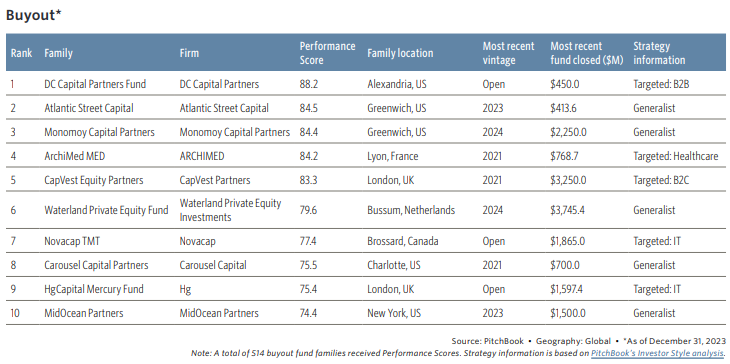

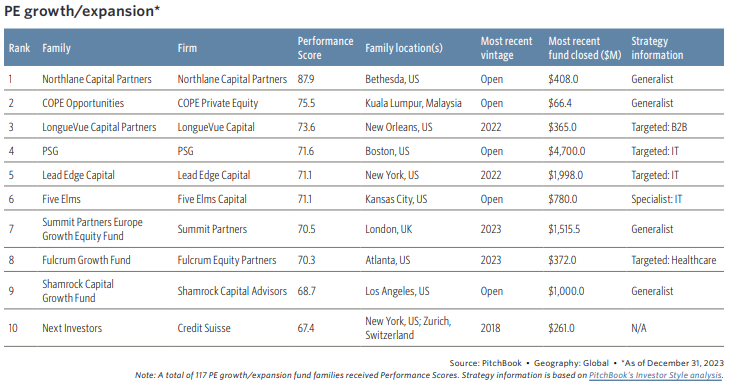

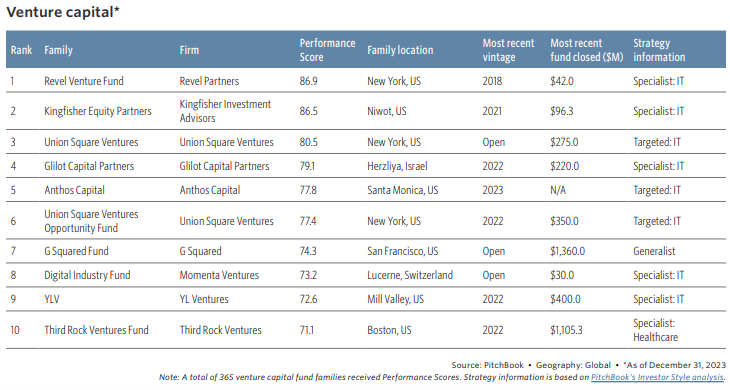

The report ranks the top-performing fund families across various private capital strategies, including buyout, venture capital, real estate, and infrastructure. The following three offer a view of the Buyout, PE Growth, and Venture Capital areas. Interestingly, in the buyout category, DC Capital Partners Fund leads with a score of 88.2, followed by Atlantic Street Capital and Monomoy Capital Partners, both of which scored above 84. Overall, it is interesting to see how well the fund families perform.

Going Beyond Traditional Benchmarks

One of the report’s key insights is its critique of traditional benchmarking methods, particularly the reliance on IRR quartiles. The report argues that such methods lack the nuance necessary to accurately assess a manager’s performance, as they fail to account for the wide dispersion of returns within quartiles. For example, a top-quartile fund might have significantly different economic outcomes compared to another fund in the same quartile due to the variability in IRRs.

To address these limitations, PitchBook’s Performance Scores offer a more sophisticated alternative. By normalizing excess IRRs through a modified Z-score and weighting each fund’s contribution based on its age, realized distributions, and performance deviation, the scores provide a more accurate reflection of a fund family’s historical performance. This approach allows for objective comparisons between peer families, even when they have divergent fund vintages.

Limitations and Disclaimers

Despite its advantages, the report acknowledges several limitations. The most significant is that historical performance is not a reliable predictor of future results. Additionally, data availability may restrict the comprehensiveness of the scores, and changes in fund management or strategy over time could affect the relevance of past performance in predicting future outcomes. The report emphasizes that while the Performance Scores are a valuable tool for due diligence, they should be used alongside other metrics and qualitative evaluations.

Conclusion

The 2023 PitchBook Global Manager Performance Score League Tables offers a fascinating analysis of private capital fund performance. By moving beyond traditional benchmarking techniques, the report provides a more nuanced and comprehensive measure of fund family performance, making it a valuable resource for LPs engaged in manager selection. However, the report also cautions against relying solely on historical performance, underscoring the importance of a multifaceted approach to due diligence in private capital markets.

Comments on this entry are closed.