Global M&A Activity Rebounds in Q2 2024

Every now and then we do a review of the global mergers and acquisitions picture (M&A). This is that reviewed based on a recent report out of private equity data provider Pitchbook. The second quarter of 2024 marked a significant turning point for the global M&A market. After a challenging period characterized by high interest rates and subdued activity, the market has shown signs of a robust recovery. This resurgence is evident across various sectors and regions, with notable improvements in deal value and count.

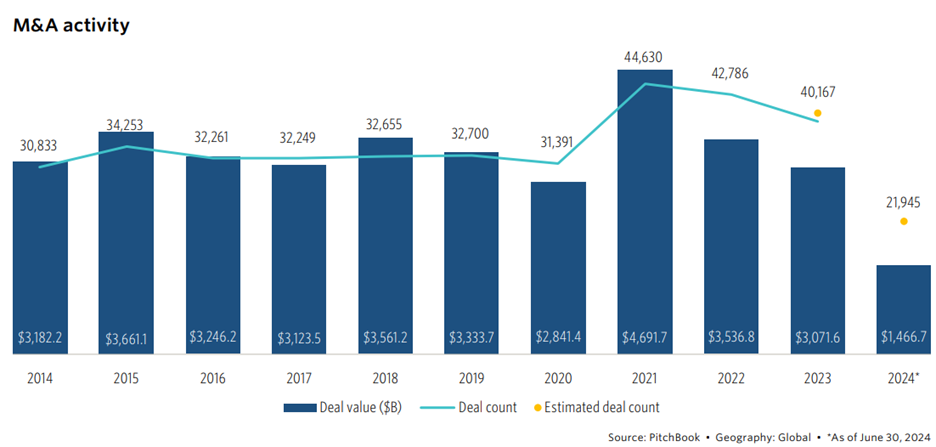

Mild Recovery in Global M&A

The global M&A market saw a notable increase in activity in the first half of 2024. Deal count and value have risen by 10% to 15% compared to 2023, signaling a mild recovery. This growth has been driven by corporate acquirers and strategic deals, with private equity (PE) activities also joining the uptrend in Q2. PE’s share of total M&A deal value rebounded to 41.0% in Q2 2024 from 33.5% in Q1, ending a nearly two-year decline. This rebound is partly attributed to better liquidity as banks re-enter the market, competing with nonbanks and resulting in lower borrowing costs despite stable central bank interest rates.

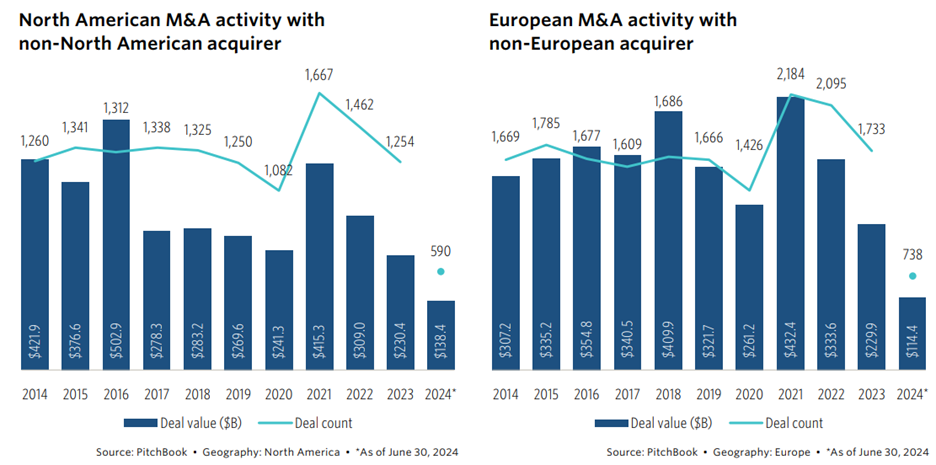

Regional Highlights: Europe and North America

Europe and North America have been key regions contributing to the recovery. European M&A activity bounced back with a 17.1% increase in deal value in Q2, following a dismal Q1. The Swiss National Bank and Sweden’s Riksbank cut interest rates, and the European Central Bank followed suit, which is expected to boost M&A activity by lowering the cost of debt. Notably, financial services in Europe experienced a 63.7% year-over-year increase in deal value, with significant transactions such as the $13.1 billion hostile takeover of Banco Sabadell by BBVA.

In North America, M&A activity advanced by approximately 13.0% year-over-year in the first half of 2024, with deal value expected to top $975 billion across nearly 9,000 deals. The top deals in Q2 included ConocoPhillips’ $22.5 billion acquisition of Marathon Oil and Johnson & Johnson’s $13.1 billion acquisition of Shockwave Medical. The energy and IT sectors were prominently represented in these transactions.

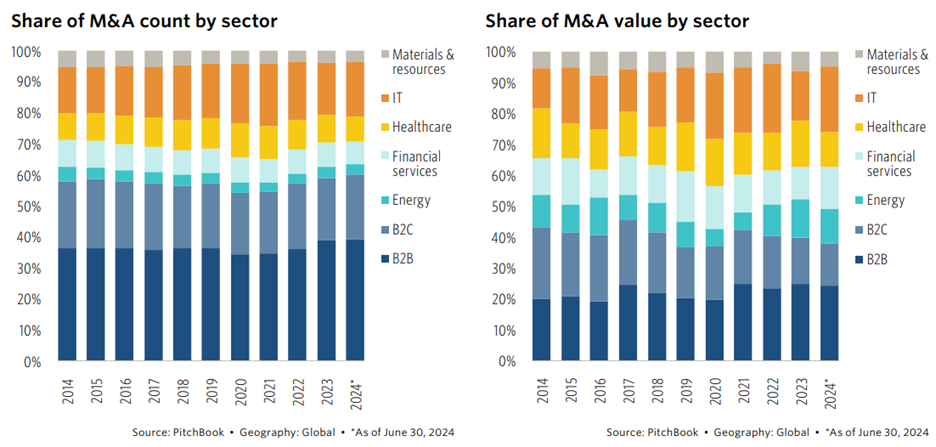

Sector Performance and Valuations

The valuation metrics for M&A transactions in North America and Europe remained stable in the first half of 2024. The median enterprise value (EV)/EBITDA multiple was unchanged at 9.5x, while EV/revenue multiples held steady at 1.6x. These multiples indicate a potential end to the valuation reset that began after the peak in 2021. Trading multiples in public markets, measured by the S&P 500, have risen, suggesting a possible bullwhip effect that could propel private company multiples higher.

Antitrust and Regulatory Challenges

Regulatory scrutiny has been a significant factor affecting M&A deals, particularly in the healthcare sector. The Illumina-GRAIL acquisition saga underscores the challenges posed by potential monopolies and increased regulatory oversight. Despite these challenges, healthcare M&A activity continues, driven by demographic trends and technological advancements. The sector remains attractive, with Big Pharma companies focusing on innovative biotech firms and promising clinical assets.

Outlook and Future Trends

Looking ahead, the M&A market is poised for continued recovery, supported by potential interest rate cuts and improved liquidity. Sectors such as financial services, materials and resources, and energy are expected to see increased deal activity as buyers take advantage of lower multiples. However, economic and geopolitical uncertainties, such as the US presidential election and ongoing conflicts, could impact the market. Nonetheless, the M&A landscape is adapting to a new normal, with a realistic mindset taking hold among buyers and sellers.

Conclusion

In conclusion, Q2 2024 has set the stage for a more robust and durable M&A recovery. As borrowing costs decline and economic conditions stabilize, the M&A market is likely to see sustained growth, with strategic and PE buyers driving deal activity across various sectors and regions.

Comments on this entry are closed.