Private equity data provider Pitchbook recently released their Q4 2023 benchmarks report, with preliminary data for Q1 2024. It provides a fascinating review on the state of the private equity and venture capital markets. Here’s a review.

Expanded Benchmarks and Methodology

PitchBook has expanded its benchmarks to include additional slices based on fund strategy and geography, allowing for more representative performance comparisons. This expansion enables users to benchmark North American funds against those in Europe and other regions. The benchmarks include dedicated data for specific asset classes such as private equity and venture capital, enhancing the granularity and relevance of the performance data provided.

The methodology behind these benchmarks incorporates both pooled and equal-weighted calculations. Pooled calculations aggregate cash flow data from multiple funds, creating a capital-weighted IRR value. Equal-weighted calculations, on the other hand, give each fund an equal impact regardless of size, ensuring a balanced view of performance metrics.

Key Performance Metrics

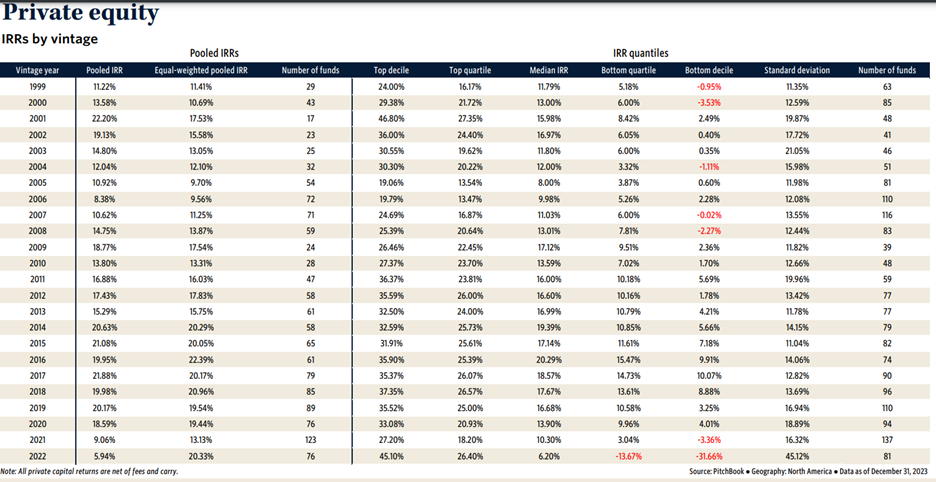

Private Equity

Private equity funds in North America showed strong performance, with a one-year horizon IRR of 3.85% in Q4 2023, though this dropped slightly to 2.13% in the preliminary Q1 2024 data. Over longer horizons, private equity continues to deliver solid returns, with a 10-year IRR of 16.75% and a 20-year IRR of 14.75%.

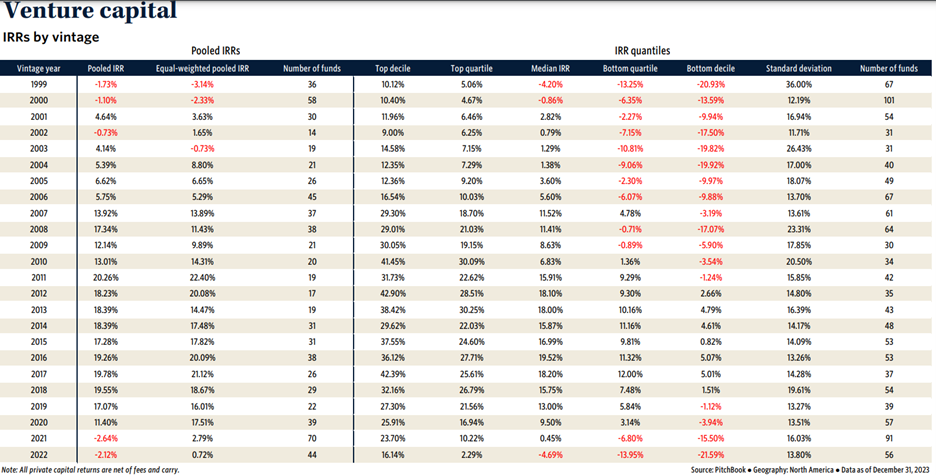

Venture Capital

Venture capital presented a more volatile picture. The one-year horizon IRR was 0.40% in Q4 2023 but improved to 1.87% in Q1 2024. Despite recent fluctuations, the long-term outlook remains positive, with a 10-year IRR of 13.59% and a 20-year IRR of 10.24%.

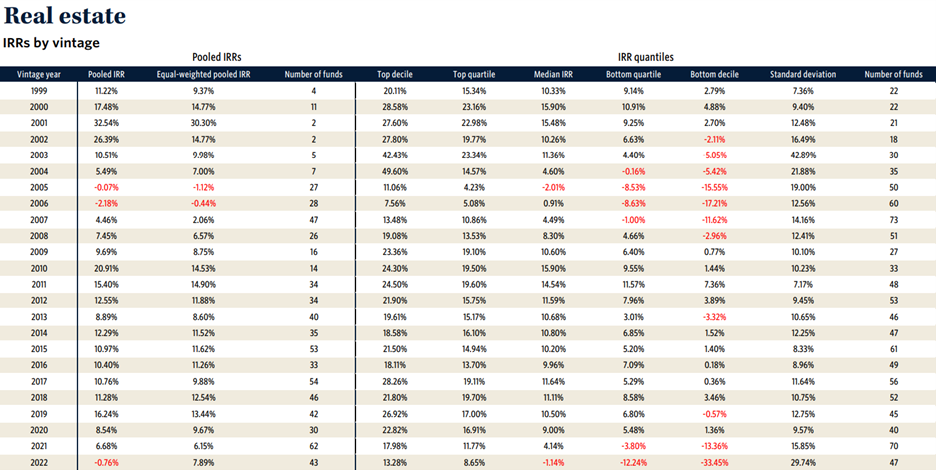

Real Estate and Real Assets

Real estate investments experienced some challenges, with a one-year horizon IRR of -2.88% in Q4 2023. However, preliminary data for Q1 2024 indicates stabilization at 0.00%. Real assets performed better, showing a one-year IRR of 3.65% in Q4 2023, which slightly increased to 3.07% in Q1 2024. Over a 20-year horizon, real assets achieved an IRR of 7.69%.

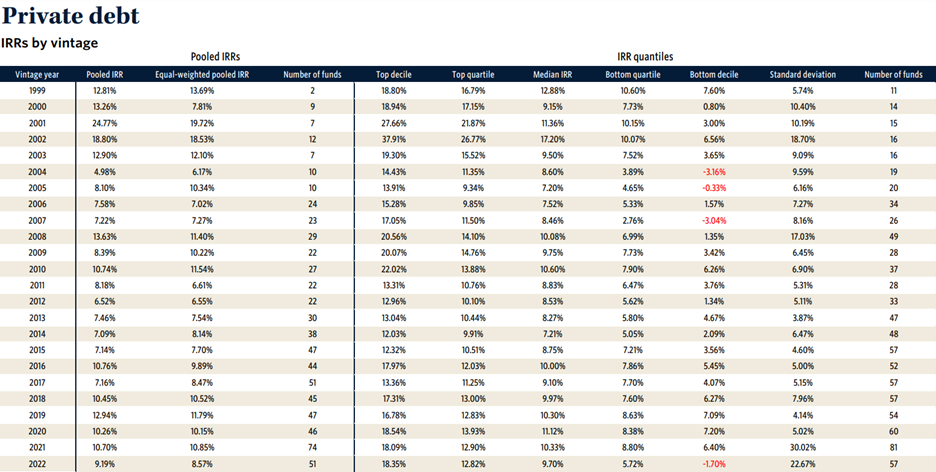

Private Debt

Private debt funds demonstrated resilience, with a one-year horizon IRR of 1.53% in Q4 2023, improving to 1.72% in Q1 2024. The 10-year and 20-year IRRs stand at 8.91% and 9.51%, respectively, indicating consistent long-term performance.

Conclusion

The PitchBook Benchmarks report underscores the robust performance and resilience of private markets in North America, despite short-term fluctuations in certain asset classes. The comprehensive data and methodological backdrop seem relatively rigorous. As private markets continue to evolve, we will continue to watch these benchmarks, as they provide critical insights into the investment landscape.

Comments on this entry are closed.