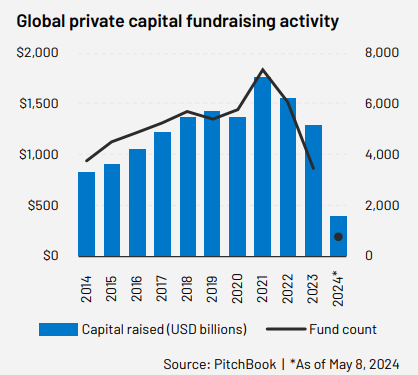

The 2024 Global Private Capital Fundraising Report by SS&C Intralinks reveals a landscape characterized by resilience and strategic adaptation in response to economic fluctuations and market challenges. In 2023, global fundraising surpassed expectations, breaking the $1 trillion threshold with $1.3 trillion raised across 3,411 funds. This marked a shift from the exuberance of the pandemic era towards a more moderated approach, mirroring pre-pandemic levels.

Fund managers have secured nearly $402 billion across 721 funds year-to-date (YTD) in 2024, compared to $460.9 billion in the same period last year. Despite a slight downturn, the sustained momentum in private equity (PE) and direct lending suggests that fundraising in 2024 may exceed the previous year’s figures. The data highlights a few outperforming fund strategies, particularly with experienced managers at the helm, indicating that creativity and adaptability are crucial for overcoming fundraising challenges.

Market Trends: A Shift in Strategy and Regional Performance

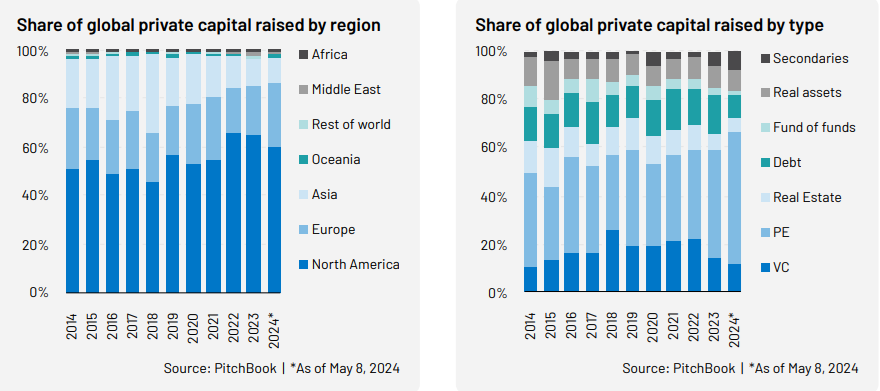

Fundraising activity in 2023 saw a 16.6 percent year-over-year (YoY) decline in capital raised. However, this does not equate to a negative outlook. The $1.3 trillion raised mirrors the historical median, demonstrating a return to pre-pandemic norms. North American and European fund managers performed relatively better, raising $836.3 billion and $262.9 billion, respectively. Rising interest rates, lower valuations, and geopolitical headwinds contributed to a challenging exit environment, particularly affecting opportunistic fundraising.

Private equity emerged as the preferred strategy, constituting 43.7 percent of capital raised in 2023. In contrast, real estate, private debt, and venture capital (VC) funds experienced YoY decreases. The focus on private equity indicates a shift in investor sentiment towards more stable and mature investments amid economic uncertainty. Additionally, real asset fundraising saw a significant increase in median fund size, reflecting a pivot towards risk aversion and diversification.

Private Debt and Direct Lending: Resilience Amid Competition

Private debt demonstrated resilience, with only a 15.3 percent YoY drop compared to the overall 16.6 percent decline in fundraising activity. The rise of private credit is overshadowing traditional bank lending and public debt markets, offering borrowers more flexibility and competitive rates. Direct lending remains the predominant fund type, driven primarily by North American fund managers. Despite a slight outflow of private debt into public debt markets, private credit remains a strong contender due to structural variables that impede riskier borrowers from accessing favorable terms through traditional bank lending.

Secondaries: A Popular Strategy for Liquidity and Stability

Secondaries funds have gained popularity as a solution to the denominator effect and the challenges of selling assets in a tough exit environment. With $81.7 billion raised across 93 funds in 2023, secondaries fundraising saw a significant uptick, reflecting the need for liquidity among limited partners (LPs). The trend continued into 2024, with $33.2 billion raised across 17 funds. Secondaries offer a means for LPs to free up capital and reduce exposure to private equity, highlighting their importance in a landscape where traditional exit channels have run dry.

Looking Forward: Digitalization and Strategic Realignment

The report underscores the importance of digitalization and strategic realignment for general partners (GPs) to attract and retain LPs while boosting returns amid uncertainty. A record-breaking 40 percent of GPs hit their fundraising targets, with only 14.1 percent missing targets as of Q2 2024. This success suggests that GPs are adopting creative solutions to navigate the slower fundraising environment. Integrating digital solutions for data management, operational efficiency, and regulatory compliance can enable managers to remain agile and prepared for future capital mobilization.

Summing Up

In conclusion, the 2024 Global Private Capital Fundraising Report highlights the industry’s resilience and adaptability in the face of economic challenges. Fund managers are strategically shifting their focus, leveraging experienced managers, and adopting digital solutions to ensure continued success in a dynamic and uncertain market.

Comments on this entry are closed.