Every quarter private equity data provider Pitchbook releases their accounting of the different market segments. Here’s a review of what they found for private equity’s (PE) middle market.

Executive Summary

In Q1 2024, US PE middle-market dealmaking showed a slight improvement over Q1 2023, following a peak of activity in Q4 2023. The increase in deal multiples in Q1 2024 indicated a stabilization of the market, supported by lower borrowing costs and higher public market valuations. The report suggests that while there is an increase in activity, the market has not yet fully recovered, as evidenced by constrained buy-side activities due to a lack of sellers.

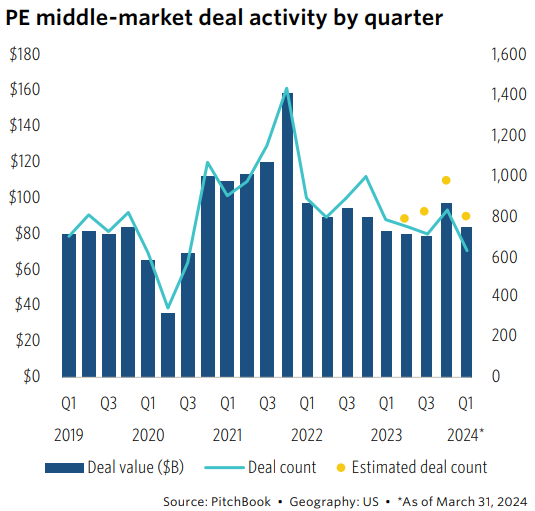

Deal Activity

Middle-market deal activity remained stable in Q1 2024, continuing the trend from Q4 2023. While the overall deal value was ahead of Q1 2023, it was still below the highs of 2021. PE firms are focusing on bringing their most attractive assets to the market, which has resulted in a narrowed scope of deal flow. This selective approach is crucial for maintaining higher valuations and successful deal completions.

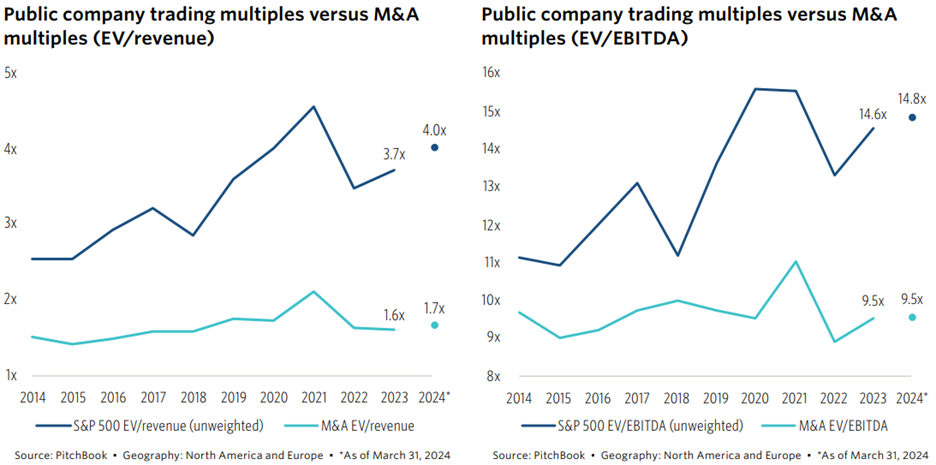

Valuations

Deal multiples for middle-market PE deals rebounded in Q1 2024. The median EV/revenue multiple rose to 2.2x from 2.0x in Q4 2023, and the median EV/EBITDA multiple increased to 12.7x from 11.0x. This recovery in valuations is attributed to lower borrowing costs and strong public market performance, which have provided a more favorable environment for PE transactions.

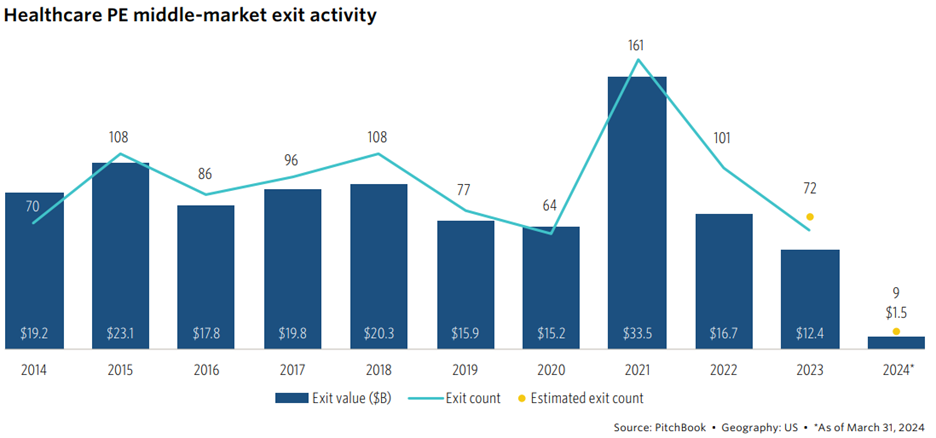

Exit Activity

Exit activity in the middle market showed signs of recovery, with a notable increase in take-private transactions. In Q1 2024, 15 take-private deals were announced or completed, up from 8 in the previous quarter. This trend is driven by the attractive valuations of small-cap public companies and reduced market volatility. The report highlights that many companies that went public during the 2020-2021 surge are now reverting to private ownership due to adjusted valuations.

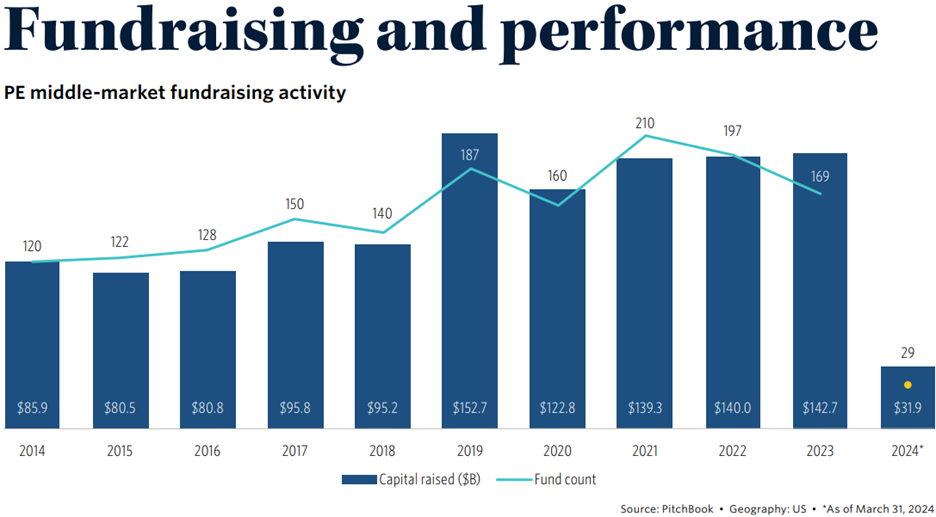

Fundraising and Performance

Fundraising in the middle market remains strong, with PE firms continuing to attract significant capital. However, the report notes that the overall returns for private equity in 2023 were lower than the historical average, reflecting the broader market conditions. The concentration of returns in a few large-cap stocks underscores the need for a broader market recovery to enhance PE performance.

Lending and Debt Markets

The report discusses the impact of the lending environment on PE activity. The average debt/value ratio for new jumbo loans backing leveraged buyouts (LBOs) decreased significantly, favoring middle-market deals due to their smaller deal values and access to private credit. The syndicated loan market saw increased activity, providing much-needed relief to PE borrowers through lower borrowing costs and more competitive lending conditions.

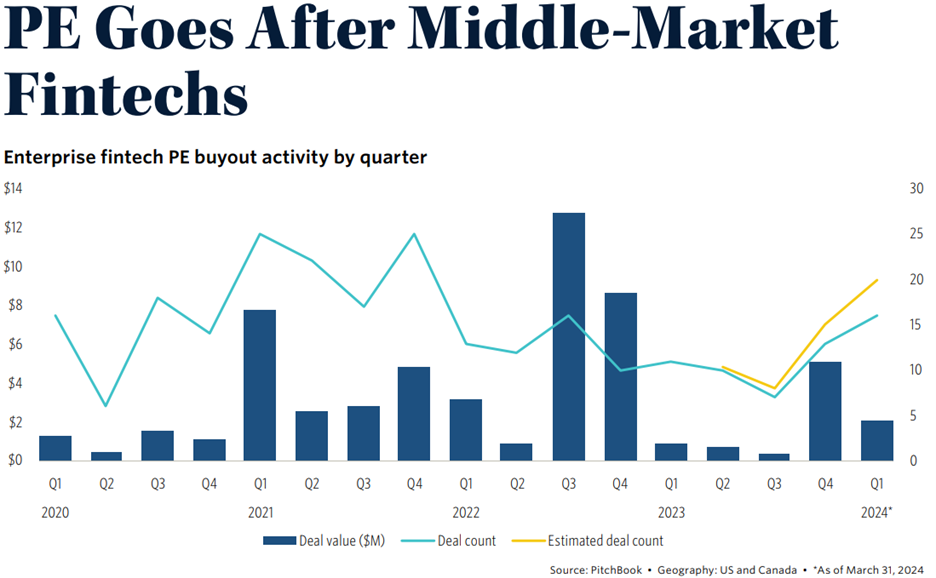

Sector Focus

The report includes a spotlight on the fintech sector, noting increased interest from PE firms in middle-market fintech companies. This trend reflects the growing importance of technology and innovation in driving value in the middle market.

Conclusion

Overall, Pitchbook’s Q1 2024 US PE Middle Market Report provides a cautiously optimistic outlook for the middle-market PE space. While challenges remain, such as constrained deal flow and the need for broader market recovery, the report highlights positive signs in deal multiples, fundraising, and lending conditions. The continued focus on high-quality assets and strategic sectors like fintech suggests that PE firms are well-positioned to navigate the current market environment and capitalize on emerging opportunities.

Comments on this entry are closed.