In the fast-paced world of startups and venture capital, early stage valuations often serve as a tantalizing yet sometimes deceptive beacon. While they provide a snapshot of a startup’s perceived value, these valuations are rife with assumptions, inflated expectations, and strategic maneuvering that can sometimes mislead founders, investors, and the market. Sometimes when put to the test by public scrutiny, early stage valuations can prove to have been way too low!

The Allure of Big Numbers

Early stage valuations can sometimes be eye-catching. A headline boasting a multi-million dollar valuation for a fledgling startup can generate significant buzz, attracting media attention, potential employees, and further investment. However, these figures can be misleading. They often reflect the potential of an idea rather than the actual performance or tangible assets of the company. Valuations at this stage are heavily influenced by market sentiment, the charisma of the founders, and the competitive landscape of venture capital rather than solid financial metrics.

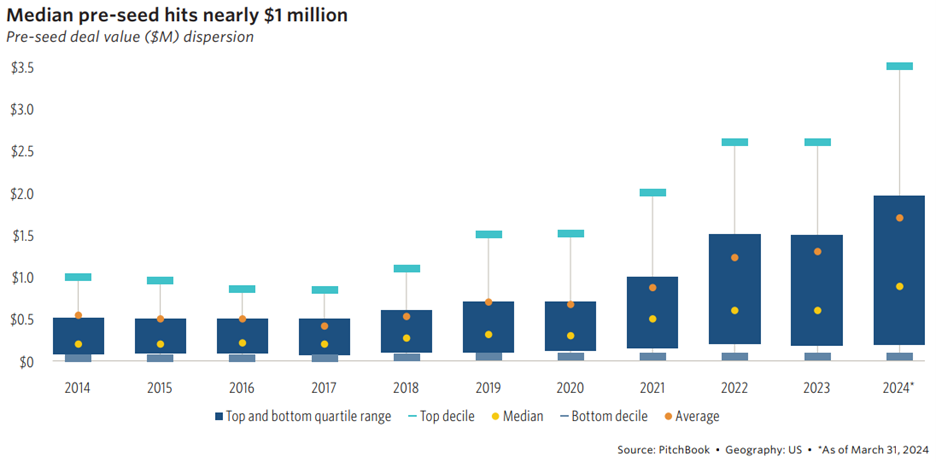

Some might point to the following graphic as case in point. The following view, from private equity data provider Pitchbook, shows the median pre-seed valuation. Amazingly, median pre-seed valuations hit nearly $1 million in the first quarter of 2024, above its previous all-time high. Compared to prior years, some might simply say “wow”.

The Role of Venture Capitalists

Venture capitalists (VCs) play a critical role in setting early stage valuations. Their goal is to invest in high-growth potential startups with the hope of reaping substantial returns. However, VCs also have an interest in securing significant equity for the lowest possible investment. This dynamic can lead to inflated valuations, especially when multiple investors compete to fund the next potential unicorn. The resulting valuations can be more reflective of investor enthusiasm than the startup’s intrinsic worth. Or, does it really?

The Risk of Overvaluation

An inflated early stage valuation can create several risks. For founders, it sets a high bar for future performance. Subsequent funding rounds will require the company to demonstrate significant growth and justify even higher valuations. Failing to meet these expectations can lead to down rounds, where the company raises funds at a lower valuation than before, which can be demoralizing for the team and damaging to the startup’s reputation.

For employees, stock options and equity grants can become less attractive if future rounds devalue the company’s stock. This can affect morale and retention, especially if the initial valuation was perceived as a promise of future wealth.

The Illusion of Market Validation

Given this background, could some be right that early stage valuations are just an illusion of market value? Well, maybe, but maybe not. A high valuation might suggest that a startup has a viable product-market fit and a strong business model, but this is not always the case. Many startups receive high valuations based on potential market size and the promise of future success, rather than current revenue or profitability. This can lead to a false sense of security, where founders and investors believe the company is on a solid path to success, only to face harsh realities as the market evolves.

The Importance of Due Diligence

For investors, due diligence is crucial in navigating the deceptive nature of early stage valuations. Beyond the headline figures, investors need to scrutinize the startup’s business model, market potential, team capabilities, and financial health. This involves asking tough questions and seeking transparency about the assumptions driving the valuation.

Founders, on the other hand, should be cautious about chasing the highest possible valuation. It’s important to balance the need for funding with realistic expectations and sustainable growth strategies. Overvaluing a company in the early stages can lead to long-term challenges that outweigh the short-term benefits of a large funding round.

Conclusion

Early stage valuations are a double-edged sword. While they can propel a startup into the limelight and attract much-needed capital, they can also be deceptively optimistic and create unrealistic expectations. Both founders and investors must approach these valuations with a critical eye, focusing on long-term viability rather than short-term hype. By doing so, they can build more resilient companies that are better equipped to navigate the unpredictable journey from startup to success.

Comments on this entry are closed.