Every private equity investor knows that most startups go bust. The rate of busting is so high that sometimes it’s a miracle that early-stage companies continue to attract well-funded, eyes-wide-open, successful investors. Why would an investor put money into startups? Well, there is, of course, the chance that an investment will explode into the next Facebook or Tesla or a thousand other unicorns that made a difference in the world of business.

Recently, Carta released some data on the state of startups. Here’s a review.

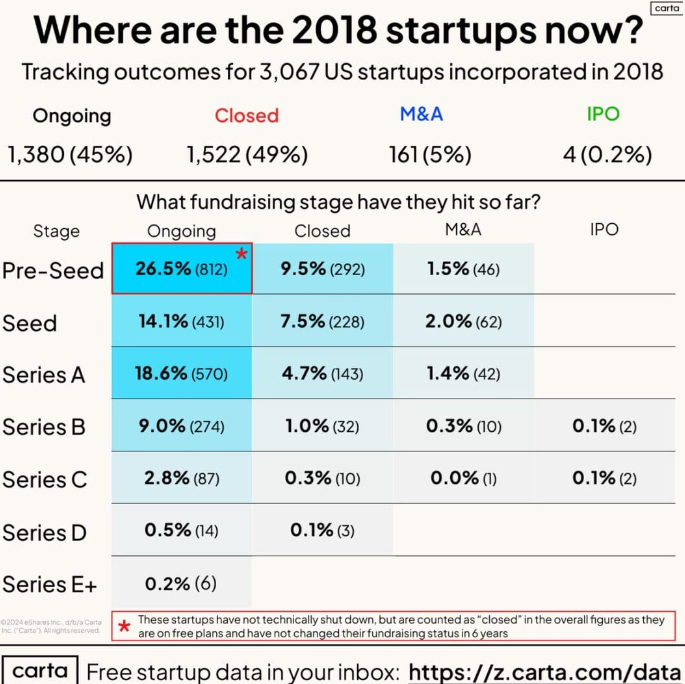

Where are 2018 Startups Now?

It’s been five years since the bright-eyed startups and their financial backers entered the world of business. Where are they now?

Well, in tracking the outcomes for 3,067 U.S.-based startups incorporated in 2018, here’s a look. Of the funded startups, a little over a quarter (26.5%) are still in business in the ongoing pre-seed stage. Is it just me or is that a long time to still be in the pre-seed phase?

In any event, the next largest group are companies still operating that are in the ongoing Series A stage (18.6%). The third largest group is the Seed round at 14.1%.

Rounding out the ongoing funding stages of funded companies, the fourth largest group of companies is Series B at 9.0%, followed by Series C at 2.8%, Series D at 0.5%, and Series E+ at 0.2%.

Switching to companies that have closed rounds, 9.5% of companies are in the Pre-Seed stage. The next largest group of companies in the closed round column are Seed at 7.5% and Series A at 4.7%.

Rounding out the list of companies are Series B at 1.0%, Series C at 0.3%, and Series D at 0.1%.

Switching to the M&A column, 1.5% of the companies were in the Pre-Seed stage that had been acquired. Interestingly, Seed companies, at 2.0%, had gone through an M&A, followed by 1.4% of Series A companies, 0.3% of Series B, and 0.0% (1 company) being Series C.

Fascinatingly, only 4 companies (0.2%) had gone through an IPO.

It is also worth noting that around half of the startups, 49%, have sadly closed.

Summing Up

Overall, the startup world continues to chug forward, albeit at a slightly slower pace than what we’ve seen in years past. In looking at the chance that a startup will be acquired as a Pre-Seed within five years of founding, the odds are (unsurprisingly) relatively low – about 1 to 1.5%. Although “may the odds ever be in your favor” may not apply here, investors continue to allocate money to the world of startup ideas, ever in search of the return that cannot be gained elsewhere.

Comments on this entry are closed.