Every now and then private equity data provider Pitchbook releases a new report that catches the eye. This past week, Pitchbook released their take on the top 20 initial public offering (IPO) candidates for 2024. The results are based upon Pitchbook’s proprietary ranking algorithm. Here’s a look, but before you look, take a guess. Do you think you can guess any of the top 20?

Some Background First

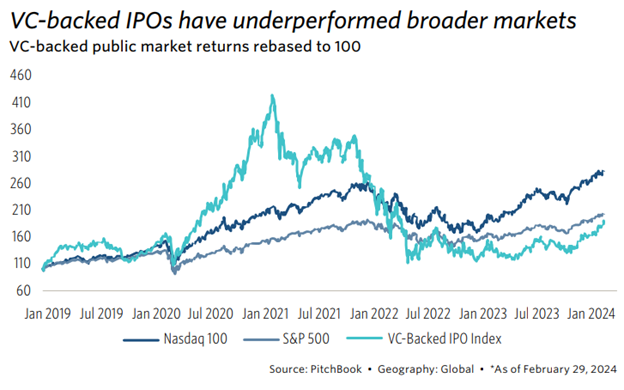

Before getting into “the list,” the following two figures provide some backdrop on the state of venture capital-backed companies. The first figure below shows the performance of VC-backed IPOs against the broader markets. Overall, based upon Pitchbook’s VC-Backed IPO Index, VC-backed companies have generally underperformed the broader markets, with the broader markets being represented by the Nasdaq 100 and the S&P 500. The difference has been stark against the Nasdaq 100, with the Nasdaq 100 up by more than double the VC-Backed IPO Index. Comparing the VC-Backed IPO Index against the S&P 500 is more even, with the VC-Backed IPO Index only slightly below the S&P 500. And, if one were to take out the Magnificent 7 from the return of the broader markets, the VC-Backed IPO Index looks much better.

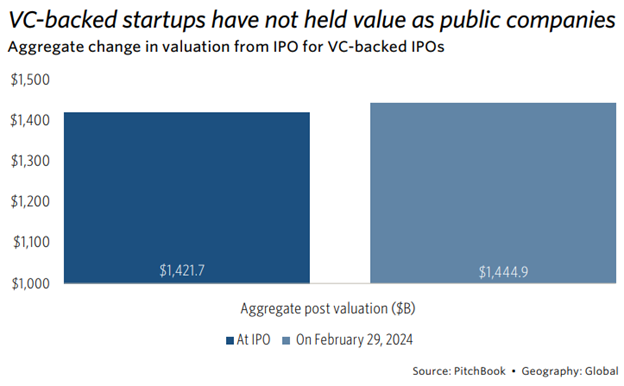

The second figure, shown below, is the value of VC-backed startups relative to when they went public. As shown, VC-backed startups have not held their value as public companies, a troubling concern for VC investors.

The Top 10 List

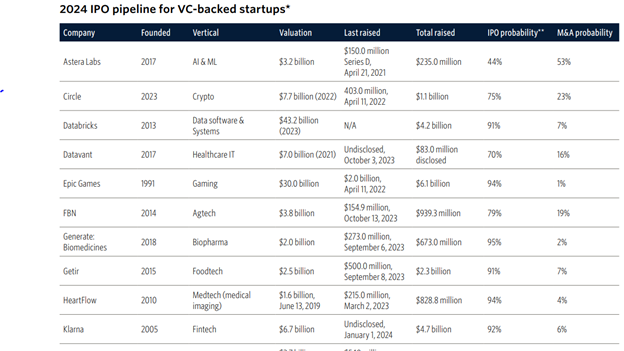

Given the aforementioned background, the following figure has the top 10 IPO targets for the 2024 VC-backed companies. Interestingly, in the top spot is Astera Labs. Founded in 2017, the artificial intelligence and machine learning startup has a value of $3.2 billion and, according to Pitchbook’s take, has a 44% chance of doing an IPO in 2024. Perhaps even more interestingly, Astera Labs has a 53% chance of being targeted by an M&A (mergers and acquisition) transaction.

In second place is crypto firm Circle. The privacy company has a 2022 value of $7.7 billion with $403 million last raised in April 2022. According to Pitchbook, the company has a 75% chance of doing an IPO in 2024 and a 23% chance of being targeted by an M&A.

In third place is data and software systems provider Databricks. The company has a pre-IPO valuation of $43 billion and has raised $4.2 billion over its life. According to Pitchbook, Databricks has a whopping 91% chance of going through an IPO in 2024, much higher than the 9% probability of being the target of an M&A transaction.

Rounding out the top five are Datavant and Epic Games. According to Pitchbook, Datavant has a 70% chance of going public in 2024 whereas Epic Games has a 94% chance.

Summing Up

Overall, Pitchbook’s 2024 outlook for the top IPO candidates provides a fascinating look at what may be on tap for the rest of the year.

Comments on this entry are closed.