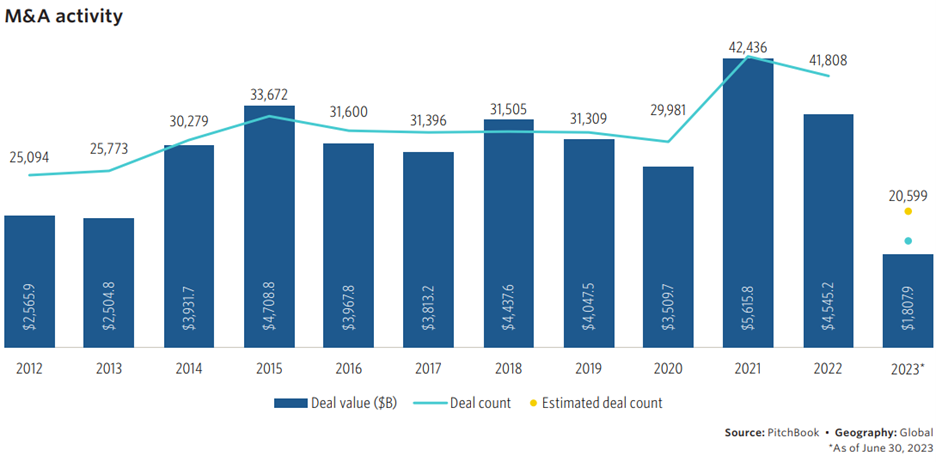

Activity in the Mergers and Acquisition (M&A) world has been relatively subdued through the first half of 2023. As shown below, M&A deal value activity stood at $1.8 trillion through June 30, 2023. That value occurred across 20,599 M&A deals. For the entire 2022 year, total deal value reached $4.5 trillion across 41,808 deals, suggesting that M&A activity is, unsurprising, slower this year compared to the prior.

In comparing what’s been seen so far for M&A activity with what we saw going back to 2012, if the current level of activity continues its trend, the 2023 M&A activity level will turn out to be the lowest since 2020. In 2020, the pandemic-induced slow down saw M&A activity reach only $3.5 trillion across 29,981. If we exclude 2020 because of the pandemic’s impact, then activity so far through 2023 suggests that by the time the year is through, overall M&A activity will be the lowest since 2013, when deal makers only saw $2.5 trillion in deal value across 25,773 deals.

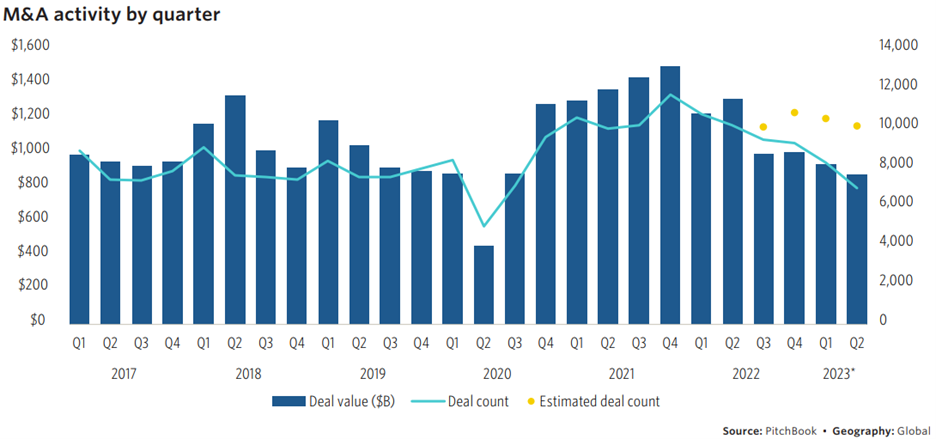

Interest Rates Clearly Show Up in the Quarterly View

What’s behind the slowdown? Many observers suggest that higher interest rates are having an effect. The effect of increasing interest rates is clearly seen through the quarterly view of M&A activity. Estimated deal count has been declining since the fourth quarter of 2022, albeit relatively slowly. Overall deal value has been declining since reaching its peak in the fourth quarter of 2021. Interestingly, the Federal Reserve began raising interest rates in March 2022, and unsurprisingly, M&A activity began slowing down as rates began to rise.

What does this mean for 2024 M&A activity?

The 2024 M&A Outlook

Given that rising interest rates are the most likely baseline for the coming year, what does the 2024 M&A picture look like for 2024?

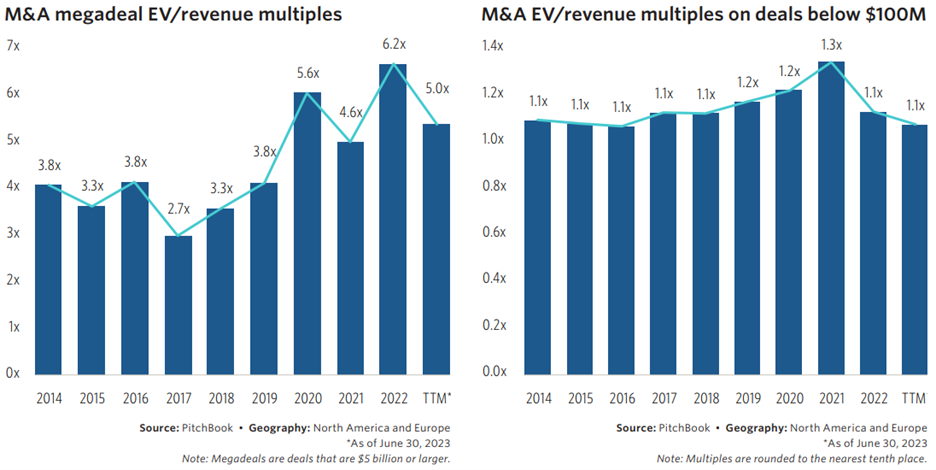

Well, the answer to this question depends partly on source of financing and the willingness of deal makers to accept lower multiples in larger (and smaller deals).

The following figure, from private equity data provider Pitchbook, shows M&A enterprise value divided by revenue multiples for megadeal and small deals. For both classifications, the multiples are declining. And given the trend heading into 2024, one fairly likely projection is that multiples will continue to decline in 2024.

Summing Up

Overall, M&A activity continues to be slower in 2023 compared to the most recent prior years. With rising interest rates heading into 2024, market observers can likely expect M&A business to continue to be subdued throughout the coming year. That is, unless interest rate setters change their mind and begin lowering interest rates in response to the slowing global economy. Time will tell.

Comments on this entry are closed.